Specialized payments platform Paysafe Limited (NYSE:PSFE) today announced its financial results for the third quarter of 2021.

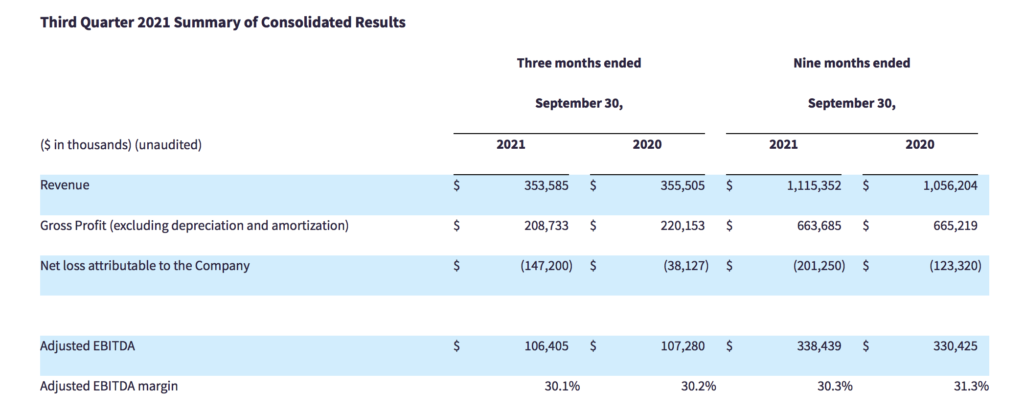

Total revenue for the third quarter of 2021 was $353.6 million, a decrease of 1%, compared to $355.5 million in the prior year. Growth was partially offset by a $7.7 million impact of a business divestiture (Pay Later) in October 2020. Excluding Pay Later, revenue increased 2%.

Revenue performance compared to the prior year also reflects the impact of actions taken to improve the Company’s overall risk/reward profile in certain markets and channels, specifically related to the exit of certain clients in the direct marketing vertical within the Integrated Processing segment, which had an unfavorable impact on growth.

Excluding the divested business and the direct marketing vertical, growth from all other revenue was approximately 5% compared to the prior year, driven by the Integrated Processing segment, including growth from both U.S. acquiring and integrated eCommerce, as well as strong growth from the eCash segment. Growth was partially offset by a decline from the Digital Wallet segment.

Net loss attributable to the Company for the third quarter was $147.2 million, compared to a loss of $38.1 million in the prior year. Net loss included a non-cash impairment charge of $322.2 million to reduce the carrying value of intangible assets in the Digital Wallet segment.

This was partially offset by a fair value gain of $94.3 million on the measurement of the warrant liability at period-end. Results also reflect a $23.3 million decrease in interest expense related to the Company’s debt refinancing which was completed in June of 2021 as well as an income tax benefit of $76.9 million compared to $14.3 million in the prior year.

Adjusted EBITDA for the third quarter was $106.4 million, a decrease of 1%, compared to $107.3 million in the prior year. Adjusted EBITDA margin was 30.1%, compared to 30.2% in the prior year.

Third quarter net cash from operating activities was $51.6 million, an increase of 37%, compared to $37.8 million in the prior year. Free cash flow was $70.2 million, compared to $58.8 million in the prior year.