What is leverage in forex trading?

Leverage in forex is a technique that enables traders to ‘borrow’ capital in order to gain a larger exposure to the forex market, with a comparatively small deposit. It offers the potential for traders to magnify potential profits, as well as losses.

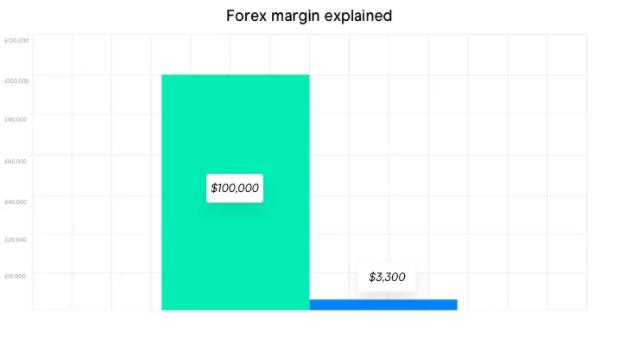

The forex market offers some of the lowest margin rates (and therefore highest leverage ratios) compared to other leveraged assets, making it an attractive proposition for forex traders who like to trade using leverage. Forex is traded on margin, with margin rates as low as 3.3%. A margin rate of 3.3% can also be referred to as a leverage ratio of 30:1. This means you can open a position worth up to 30 times more than the deposit required to open the trade.

What is leverage in forex?

Leverage in forex is a way for traders to borrow capital to gain a larger exposure to the FX market. With a limited amount of capital, they can control a larger trade size. This could lead to bigger profits and losses as they are based on the full value of the position.

Trading with leverage, which is also referred to as margin, means you can magnify profits if markets move in your favour; however you can also lose all of your capital should markets move against you. This is because profits and losses are based on the full value of the trade, and not just the deposit amount.

Forex trading comes with some of the lowest margin rates in the financial markets. The leverage difference between forex and stocks, for example, is much higher. Stock market leverage starts at around 5:1, which makes trading within the share market slightly less prone to capital risk.

What does a margin call mean?

Any deposits used to keep positions open are held by the broker and referred to as ‘used margin’. Any available funds to open further positions are referred to as ‘available equity’ and when expressed as a percentage, ‘margin level’.

A margin call occurs when your margin level has dropped below a pre-determined value, where you are at risk of your positions being liquidated. Margin calls should be avoided as they will lock in any of the trader’s losses, hence the margin level needs to be continuously monitored. Traders can also reduce the chance of margin calls by implementing risk management techniques.

Forex leverage calculator

A forex leverage calculator helps traders determine how much capital they need to open a new position, as well as manage their trades. It also helps them to avoid margin calls by determining the optimal position size.

The formula for forex leverage is:

L = A / E

where L is leverage, E is the margin amount (equity) and A is the asset amount.

You can also start with the margin amount and apply a leverage ratio to determine the position size. In this instance, the formula would be A = E.L. Therefore, multiplying the margin amount by the leverage ratio will give the asset size of a trader’s position.

How to Manage Forex Leverage Risk

Leverage can be said to be a double-edged sword, providing both positive and negative outcomes for Forex traders. This is why it is imperative to identify the appropriate effective leverage and incorporate sound risk management.

Top traders use stop losses to limit their downside risk when trading forex. Forex Tianyan recommends taking no more than 1% of account assets for any single transaction and no more than 5% of account assets for all open trades at any point in time.

Also, avoiding leverage errors is critical for successful traders who use a positive risk-reward ratio to try to achieve higher probability trades over time.