As the transition away from LIBOR progresses and the UK Financial Conduct Authority (FCA) has recently announced that publication of 24 LIBOR settings has ended, the FNG team has reviewed how major Forex and CFD broker have acted in response to the changes. In fact, a number of leading online trading companies, such as IG, CMC Markets, FOREX.com and OANDA, have taken action to inform their customers of the changes concerning IBOR transition.

- OANDA:

OANDA has implemented changes in response to the transition away from old rates back in November 2021.

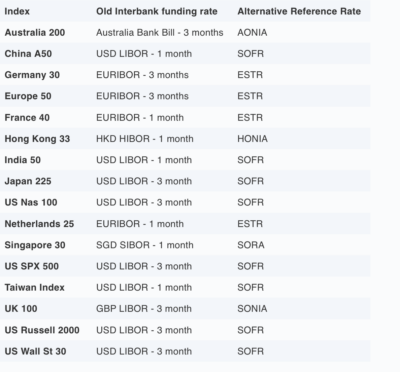

The table below shows what each index product uses currently as its applicable funding rate and which Alternative Reference Rate OANDA has been using starting from 29 November 2021.

IBOR users are switching to Alternative Reference Rates (ARRs). ARRs are based on actual overnight interest rates in liquid wholesale cash and derivative markets. This makes ARRs more robust and less volatile than IBORs.

Since ARRs are risk-free rates, they don’t incorporate the credit risk that is inherent in the calculation of IBORs, which are based on interbank lending over longer time periods.

If you hold an index position at the end of the trading day (5pm ET), the position is considered to be held overnight and subject to either a financing charge or credit to reflect the cost of funding your position (in relation to the margin utilised).

On an index, this is calculated as:

Daily financing charge or credit = value of position* x applicable funding rate/365**

The applicable funding rate in this example will change from an Interbank Offer Rate (IBOR) to Alternative Reference Rate (ARR). For example, on the US Wall St 30, your applicable funding rate would change from USD LIBOR – 3 month to SOFR (Secured Overnight Financing Rate).

- FOREX.com

FOREX.com and City Index, which are now owned by StoneX, have also taken early action in response to IBOR transition.

If you hold a short-term trade and want to keep it open overnight, you’ll be charged a daily interest fee.

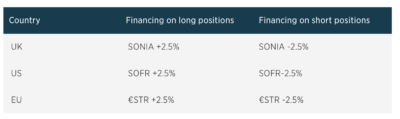

The financing charges reflect the cost of borrowing or lending the underlying asset and are charged at LIBOR (or equivalent IBOR) +/- 2.5% on the total value of the position.

Since 7 May 2021 clients of FOREX.com have been charged a rate approximating to the new benchmark +/- 2.5%. These charges will remain competitive in order to keep the cost of trading low.

- CMC Markets

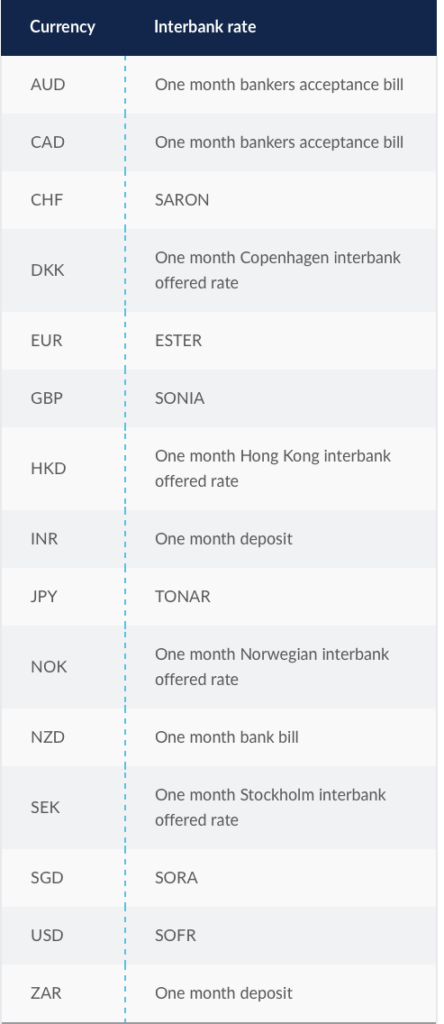

CMC Markets explains that LIBOR has been replaced by a new interbank rate for the following currencies: GBP, USD, EUR, CHF, JPY and SGD. The table below shows the new interbank rates. Overnight holding costs will be charged based on the new benchmark rate, plus or minus our fee depending on whether you hold a buy or sell position in an index, share or share basket. Based on the new benchmark rates compared with Libor, CMC Markets does not expect a material change in holding costs.

- IG UK

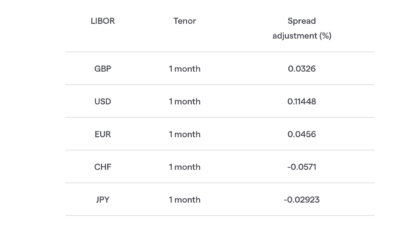

To compensate for the missing credit risk, IG has adjusted the ARRs by the one-month spread adjustment proposed by the International Swaps and Derivatives Association (ISDA).

IG used IBORs for the calculation of overnight funding charges on index and share positions. These have now been replaced by an ARR and a spread adjustment, meaning you’ll be charged fees according to the adjusted ARR benchmark +/- an IG admin fee.

- ThinkMarkets

Online trading company ThinkMarkets has announced new overnight funding benchmarks.

As of 13 December 2021, the broker has changed the interbank benchmark rate used to calculate overnight interest. This is due to a number of current Interbank Offered Rates ceasing to exist, including London Interbank Offered Rate (LIBOR).

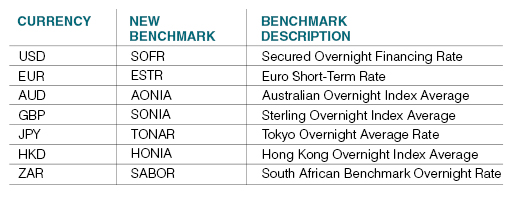

ThinkMarkets will be replacing the current LIBOR benchmark with new benchmarks.