Citigroup Inc (NYSE:C) has just posted its financial report for the final quarter of 2021.

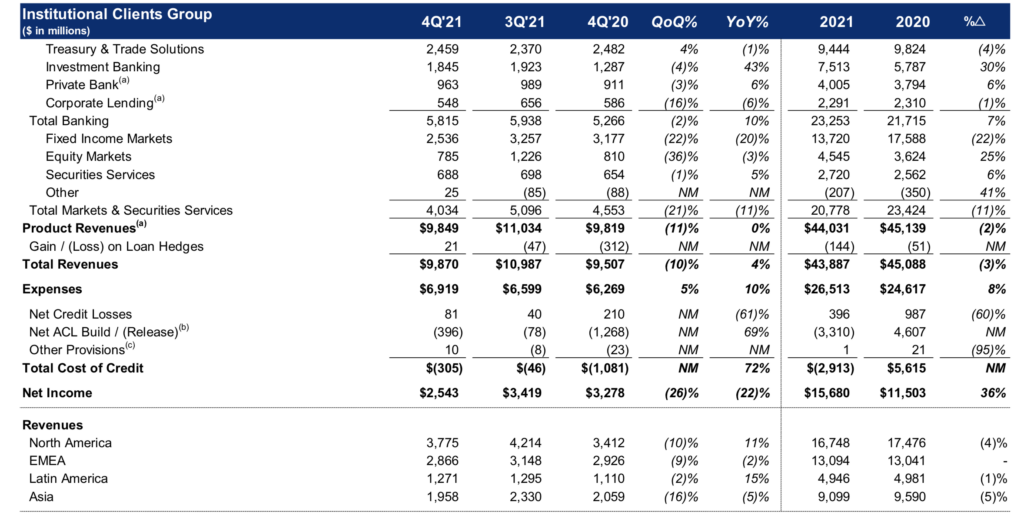

Citi reported Institutional Clients Group (ICG) revenues of $9.9 billion, up 4% from the same period in 2020, primarily driven by higher revenues in Investment Banking, the Private Bank and Securities Services, partially offset by a decline in Fixed Income Markets.

Markets and Securities Services revenues of $4.0 billion decreased 11% from the year-ago quarter. The result also lagged behind the $5 billion in revenues registered in the third quarter of 2021.

Fixed Income Markets revenues of $2.5 billion decreased 20%, as solid growth in FX and commodities was more than offset by a decline in rates and spread products. Equity Markets revenues of $785 million decreased 3%, as continued growth in prime finance balances and structured activities was offset by a decline in cash.

Securities Services revenues of $688 million increased 5% on a reported basis and 7% in constant dollars, driven by higher settlement volumes and higher assets under custody, partially offset by lower deposit spreads.

Across all segments, Citigroup reported net income for the fourth quarter 2021 of $3.2 billion, or $1.46 per diluted share, on revenues of $17.0 billion. This compared to net income of $4.3 billion, or $1.92 per diluted share, on revenues of $16.8 billion for the fourth quarter 2020.

Revenues increased 1% from the prior-year period, primarily driven by strong growth in Investment Banking in the Institutional Clients Group (ICG) and higher revenues in Corporate / Other, partially offset by lower revenues across regions in Global Consumer Banking (GCB).

Net income of $3.2 billion decreased 26% from the prior-year period, reflecting higher expenses, partially offset by higher revenues and lower cost of credit. Results for the quarter included a pre-tax impact of approximately $1.2 billion ($1.1 billion after taxes) related to the divestitures of Citi’s consumer banking businesses in Asia.

Earnings per share of $1.46 decreased 24% from the prior-year period. Excluding the impact of Asia divestitures, earnings per share of $1.99 increased 4%, primarily reflecting a 4% reduction in shares outstanding.

For the full year 2021, Citigroup reported net income of $22.0 billion on revenues of $71.9 billion, compared to net income of $11.0 billion on revenues of $75.5 billion for the full year 2020.