The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

Contrary to anything we’ve seen earlier, the pandemic actually led to a deluge of dollars in the financial markets. The Nasdaq added over 40% in 2020. So far this year, the S&P 500 has climbed to 47 record highs. These inflows are exciting, but what this points to is a crowded market with some grossly overvalued stocks. Yet, billions of dollars remain on the sidelines – eagerly awaiting to buy price dips and trying to identify an investment narrative that’s worth their money.

This overly positive market sentiment represents a conundrum for investors. Does one invest in household-name stocks with inflated values? If not, then how do you identify the next Amazon or Netflix? Investors could consider what we call “lookalike” stocks.

A lookalike stock is one that has much of the same attributes as a standout stock that has spiked during the pandemic. However, because the company is not as well-known, the stock may not have added as much. Exposure to these lookalikes can help investors simulate exposure to price action in a popular stock.

Priced Out

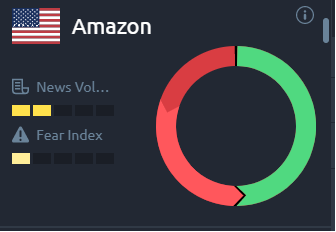

If there’s one company that benefited from the pandemic, it’s Amazon. It’s an absolute standout stock and synonymous with explosive growth. While cloud computing and advertising are Amazon’s outperformers, it is also the largest e-retailer in most economies in which it operates. Amazon, at the helm of the phenomenal growth of the ecommerce industry, posted an 84% surge in its net profits in 2020.

However, Amazon has not announced a stock split in recent years, and its extraordinary growth has made the stock frightfully expensive. The stock trades above $3,200, with a spectacular trailing PE of 57.39.

However, Amazon has not announced a stock split in recent years, and its extraordinary growth has made the stock frightfully expensive. The stock trades above $3,200, with a spectacular trailing PE of 57.39.

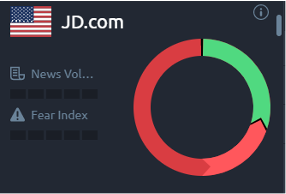

Investors seeking exposure to the rapidly expanding ecommerce industry may consider cheaper stocks that are similar to Amazon. In China, 25% of retail spending has moved online. A statistic that is swiftly rising. This demand is being met by Alibaba and JD.com. JD.com is listed on the Nasdaq too, trading at a much more affordable $70, with a relatively reasonable trailing PE of 13.82. JD.com boasts breakneck delivery speeds and has only 30 days of inventory, comparable to Amazon’s 26.5. This pace of service is due to the company’s recent aggressive reinvestment, which has depressed its earnings and, therefore, its stock value.

The scale of JD.com’s delivery infrastructure across China has meant that the company is close to achieving the economies of scale that Amazon enjoys. In addition, JD.com is also China’s largest supermarket operator and biggest pharmacy – two industries that Amazon has been trying hard to penetrate. We believe JD.com’s stock has significant upside potential. Investors excited about the ecommerce industry but skeptical about Amazon’s lofty valuation may choose to invest in JD.com instead.

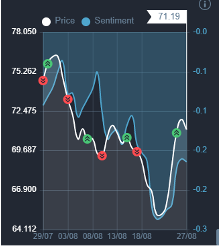

Sentiment for JD.com and Alibaba mirrors Amazon, as reflected in the Acuity Trading Dashboard. This is despite the fact that there is far more upside to JD.com and Alibaba than Amazon and much more downside to the ecommerce behemoth than to its China-based rivals.

Diversified Exposure

Berkshire Hathaway is one of the most prominent names in the investing world.

While not many of the P&C insurer’s shareholders may object to the investment strategy followed by CEO Warren Buffet and Vice Chairman Charlie Munger, there are lookalikes to access investments that are too trivial for Berkshire’s massive asset pool. The company has a market capitalisation of $496 billion and a float of $138 billion, which is the biggest globally. Of course, its stock reflects these positives.

One possible lookalike is Markel Corp. Its investing wing generated operating income of more than $254 million in 2020 through its global investments. The insurer invests in local businesses that Berkshire might not bother with. Additionally, Markel has an extremely low stock turnover, with its investment philosophy focusing on holding equities in perpetuity. Markel’s stock has performed much like Berkshire’s, having a correlation of 0.96 with the larger insurer, making it an attractive lookalike for investors who wish to diversify their exposure.

Missed Out on a Rally?

The US equity market seems to have developed the habit of setting new record highs. However, for every investor who has ridden the highs, a few have missed out. Tesla, for example, has benefitted from the ESG investing trend. The electric vehicle company’s stock has gained more than 6X since the beginning of 2020. Many investors who either could not take advantage of Tesla’s rally or are interested in exposure to green investments may watch for lookalikes that may be poised for an uptrend. Through 2020, Chinese EV maker NIO followed Tesla’s surge. NIO climbed 696%, versus Tesla’s 1,429%. While its stock has cooled off since, NIO remains an attractive lookalike in the green investing market.

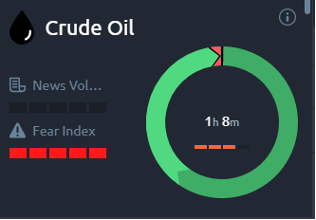

In 2021, Dutch EV maker Stellantis kept pace with Tesla’s returns rally and exceeded it. A Stellantis share bought at the beginning of the year would have returned nearly 20%, while Tesla’s would have offered 1.63% since it is at the tail end of its rally. Both NIO and Stellantis may have more steam left in their stocks than Tesla. Moreover, the rising price of crude oil, driving by the global economic recovery, could lend further upside to the EV space.

Look for Lookalikes

In a speech in 1963, President Kennedy said that “a rising tide lifts all boats”. Lookalikes, too, are likely to be lifted by the tides of the broader market momentum. However, a lookalike’s sensitivity to rising market tides is not an exact science, and much depends on the rally’s drivers. Nevertheless, they are stocks to include in your watchlist and monitor along with their better-known counterparts.