Is a stop loss truly necessary? “Yes,” is the fast answer. “Yes, if you choose not to blow up your Forex trading account,” is the extended version of the response. There are a variety of reasons to use a stop loss, but there are several tactics that may be used to avoid using one, albeit doing so is normally reserved for institutional traders.

Your best buddy is the stop loss.

Because currency markets can become volatile at any time, the stop loss is your best friend. There may be a surprise announcement, an event taking place halfway over the world, or, worst of all, something happening while you are sleeping. Because you can’t forecast everything that will happen, the stop loss serves as your guardian angel. When it comes to the Forex markets, there are a slew of reasons why you can observe a price surge.

For example, the Swiss National Bank has defended the 1.20 level in the EUR/CHF pair in recent years, refusing to allow the pair to go below that level since the Swiss franc had become far too costly. The SNB, however, abruptly abandoned the peg on January 15, 2005, allowing the market to fall since they had been guarding that level for a couple of years and it had now become too expensive. Because it was “easy money,” large sums of institutional money poured in and bought the pair whenever it approached the 1.20 level. The pair, however, crashed and plunged several candles in milliseconds as soon as the Swiss moved away from the currency markets.There were examples all around the world of retail traders who were wiped out because they failed to exercise basic sense and put in a stop loss.

Consider yourself an American merchant. You held a EUR/USD trade and relied on the Swiss National Bank to safeguard you. On January 15, you wake up to find that your bank account is empty. Your broker is wanting more margin, and for other clients, it was much worse: they owed money to their brokers because orders were not being processed quickly enough.

Granted, this is an extreme case, but it is not uncommon for a pair like the GBP/JPY to drop 120 pips while you sleep. Stop loss is sometimes referred to as a “disaster stop,” but it’s actually meant to protect you when your analysis is inaccurate, and let’s face it, erroneous analysis is a part of the game.

There’s a reason why stop losses exist.

Stop losses are not only in place to safeguard your account from disaster, but they also serve as a “line in the sand” for when your analysis is shown to be inaccurate. If it turns out to be erroneous, you just depart the market and recognize that you have another day to battle.

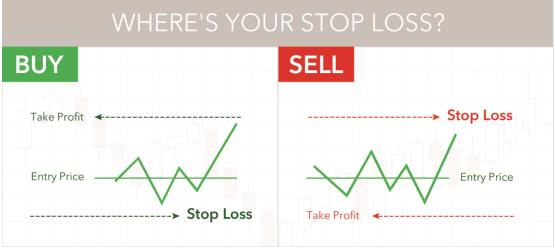

Unfortunately, far too many of you will move stop losses to prevent losing money, but a good trader is prepared to cut losses promptly. Finally, a smart trader realizes that if your analysis is shown to be erroneous, it is preferable to limit your losses. Moving your stop loss in your favor to lock in winnings is a totally fair approach if your analysis is confirmed to be the correct analysis. This allows the market to warn you when it’s time to exit after a significant gain.

Never trade without a stop loss in place.

Under no circumstances should you trade without a stop loss. You might lose a lot of money for a variety of reasons. Granted, some of the arguments I’ve made in this essay are a little exaggerated, but at the end of the day, you never know when something unexpected will occur. It’s also a means to force your account back to neutral if the deal doesn’t work out. You may even utilize it to benefit if the market reverses course after a large rise in your favor.

People who felt they were wiser than the market and couldn’t be bothered to take a loss are scattered across the Forex sector. Other than reducing your losses and building on your winnings, there is no such thing as a “100% effective approach.” Losses are unavoidable, therefore the only thing you can do is protect yourself.