StoneX Group Inc. (NASDAQ: SNEX), a diversified global brokerage and financial services firm, has announced its financial results for the fiscal year 2022 first quarter ended December 31, 2021.

Operating revenues derived from FX/CFD contracts increased $12.4 million, or 21% to $72.2 million in the three months ended December 31, 2021 compared to $59.8 million in the three months ended December 31, 2020. This was mainly a result of a $12.1 million increase in operating revenues derived from retail FX/CFD in StoneX’s Retail segment.

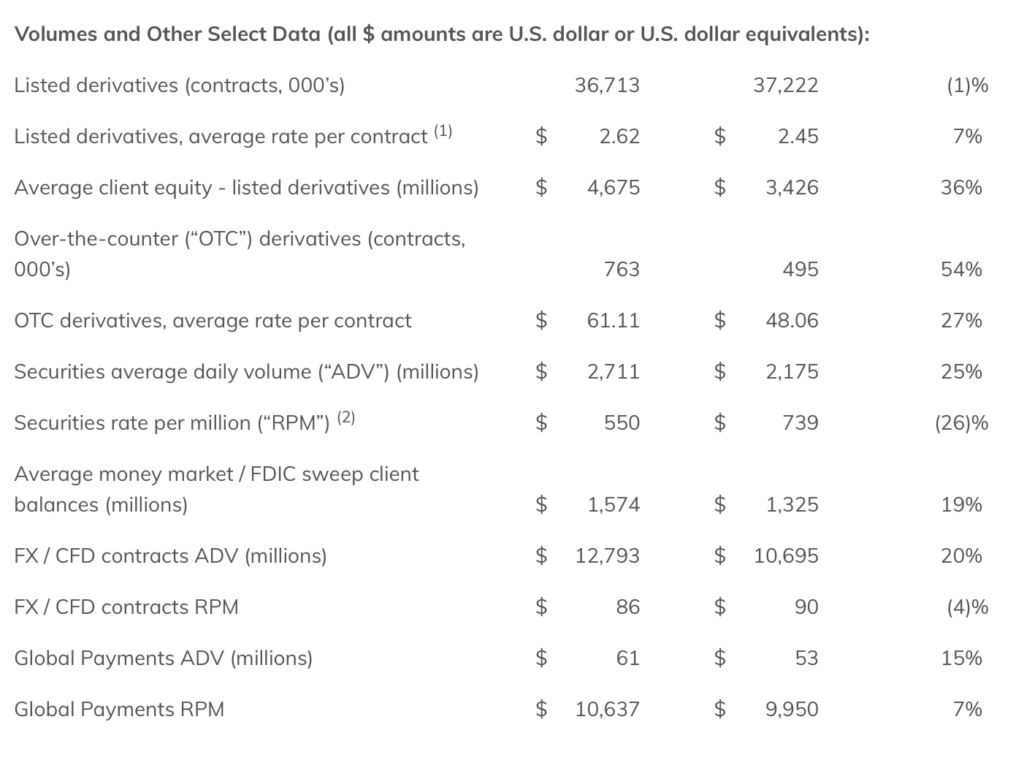

Across all segments, operating revenues increased $70.4 million, or 19%, to $450.5 million in the three months ended December 31, 2021 compared to $380.1 million in the three months ended December 31, 2020.

Operating revenues for the three months ended December 31, 2020 included a $3.7 million unrealized loss on derivative positions used to mitigate StoneX’s exposure to the British Pound in the acquired Gain subsidiaries in advance of the March 1, 2021 transfer of the majority of the operations of Gain’s U.K. domiciled subsidiaries into StoneX Financial Ltd., a U.S. dollar denominated entity.

In addition, as the Gain U.K. subsidiaries had a functional currency of British Pound, the increased U.S. dollar exposure resulted in a $2.7 million foreign currency loss on revaluation for the three months ended December 31, 2020. Each of these items were reflected in operating revenues in the Corporate Unallocated segment.

Quarterly net income amounted to $41.7 million, whereas quarterly diluted EPS were $2.04 per share, up 108% from a year earlier.

Sean M. O’Connor, CEO of StoneX Group Inc., stated,

“We delivered strong results in our fiscal first quarter with a diluted EPS of $2.04, an ROE of 18.0% on book value and 20% on tangible book value. We continued to experience higher volumes across the board from increased client engagement and market share gains. Increased market volatility and the prospect of rising interest rates provide additional catalysts for continued growth.”