StoneX Group Inc (NASDAQ:SNEX) has published detailed compensation data concerning its top management, including Glenn Stevens, the former CEO of online trading company GAIN Capital, which was acquired by StoneX in the summer of 2020.

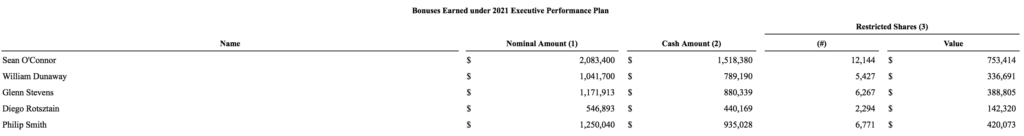

Mr Stevens, who joined StoneX as Head of Retail and Foreign Exchange on August 1, 2020, earned a bonus of $1,171,913 under the StoneX 2021 Executive Performance Plan.

The annual base salary for Glenn Stevens in 2021 was $500,000.

Messrs. Stevens and Rotsztain, as former executives of GAIN, were eligible to participate in GAIN’s annual executive bonus plan. Pursuant to this plan, Messrs. Stevens and Rotsztain were assigned an annual bonus target, with the final bonus amount determined by the compensation committee based on the financial performance of GAIN relative to specified financial targets and a qualitative assessment of their performance. These bonuses were paid in cash.

The final bonus paid to Messrs. Stevens and Rotsztain under the GAIN annual executive bonus plan was paid in March 2021 in respect of the calendar year ended December 31, 2020, which was the last full fiscal year of GAIN.

GAIN entered into an employment agreement with Mr. Stevens on October 22, 2018, which was subsequently amended on August 3, 2020. The Agreement provides for an annual base salary and provides that Mr. Stevens is eligible to receive a target annual bonus determined as a fixed percentage (which for fiscal year 2021, is 75%) of the Chief Executive Officer’s target annual bonus for the applicable fiscal year (the “Target Bonus”), which amount will be paid approximately 70% in cash and 30% in restricted stock that vests ratably over three years (with the number of shares determined using a 25% discount to fair market value).

For fiscal year 2021, Mr. Stevens’ Target Bonus was prorated based on the nine months he participated in the Company’s bonus program. The Stevens Agreement also provides that Mr. Stevens is eligible to participate in the Company’s LTIP plan, which provides for performance-based cash awards. For fiscal 2021, Mr. Stevens received an LTIP award with a target value of $500,000 that is subject to a five-year cliff-vesting requirement.

The Stevens Agreement further provides that Mr. Stevens is entitled to four additional LTIP awards with a $500,000 target value which vest in 2021, 2022, 2023 and 2024, respectively, as of the close of the applicable LTIP plan year.

Mr. Stevens is also subject to confidentiality, non-competition and non-solicitation covenants. The non-competition and non-solicitation provisions were designed to prevent him from competing with StoneX or soliciting StoneX customers or employees for a period of 18 months following his termination of employment for any reason (or, in the case of a termination without Cause or resignation Good Reason following a Change in Control, for a period of 6 months).

Mr. Stevens’ right to receive severance is conditioned upon his being in compliance with the confidentiality, non-competition and non-solicitation covenants of his agreement. In the event Mr. Stevens breaches any of these covenants, any severance amounts that he has received are subject to repayment.

Pursuant to the terms of the Stevens Agreement, in the event Mr. Stevens’ employment is terminated without “cause’ or he resigns for “good reason” (as each such term is defined in the Stevens Agreement) at any time after February 1, 2022 (the 18-month anniversary of the acquisition of GAIN by us (the “Merger Date”)), then, subject to his execution and non-revocation of a general release of claims, as well as his compliance with the restrictive covenants set forth in the Stevens agreement, Mr. Stevens is entitled to receive the following (all such benefits, the “Non-Change in Control Severance Benefits”):

- Cash severance in an amount equal to (i) 24 months’ base salary payable in equal installments over the 24-month period following his last day of his employment and (ii) two times Mr. Stevens’ Target Bonus for the fiscal year in which the termination of employment occurs, which amount will be payable in installments over the 12-month period following his last day of his employment (the “Cash Severance Amount”);

- a pro rata Target Bonus (the “Pro Rata Bonus”), which amount will be payable at the time the annual bonus is payable to other executives;

- the accrued but unpaid bonus for the year prior to termination;

- to the extent unpaid as of Mr. Stevens’ last day of employment, the deferred cash award described above under “Legacy Capital Holdings Inc. Incentive Plans” will be accelerated in accordance with its terms; and

- continued health benefits at the same premium rates charged to other current employees, or at the Company’s option, waiver of that portion of the cost for COBRA continuation coverage that is in excess of what then current employees pay for their health benefits, for the 24-month period following termination of employment.

If Mr. Stevens’ employment is terminated due to death or “disability” (as defined in the Stevens Agreement), he will be entitled to the following:

- Cash severance in an amount equal to 24 months’ base salary payable in equal installments over the 12-month period following his last day of his employment (and within 30 days following his death);

- a pro rata bonus based on an estimate of actual performance based on the achievement of performance through Mr. Stevens’ termination date, which amount will be payable at the time the annual bonus is payable to other executives; and

- the accrued but unpaid bonus for the year prior to termination.

To the extent Mr. Stevens’s employment is terminated prior to February 1, 2022 for any reason other than a termination by the Company without “cause” or a resignation by Mr. Stevens for “good reason”, the aggregate amount of severance payable to him (or his estate) shall be reduced by the value of any amounts that are paid to him prior to or within 10 days after the effectiveness of the general release in excess of an annual rate of $1,500,000 with respect to services rendered after the Merger Date and prior to the termination of employment.

Glenn Stevens was a founder and Chief Executive Officer of GAIN for over twenty years, building a business offering retail traders the ability to trade various financial products. Mr. Stevens has over thirty-five years experience in financial markets focusing on Forex products. Prior to GAIN, he held various senior roles for large financial institutions including NatWest Bank, Bank of America (Merrill Lynch) and Bankers Trust.