Less than a month after Citadel Securities responded to the complaint brought by investors who suffered heavy losses during the January “short squeeze”, the traders have also filed their response.

In fact, a number of documents were filed by the plaintiffs in the multi-district litigation on September 21, 2021. These documents include not only the response to the defendants’ motion to dismiss the antitrust tranche complaint, but also several amended complaints. FX News Group has examined the response and the corrected complaint in the antitrust tranche, so that more details are provided to the readers.

Evidentiary details would be important as the motion to dismiss attacks the complaints on several grounds, with the main one being that the complaint fails to set forth allegations of an anticompetitive agreement.

The traders say that the defendants are incorrect, as the complaint “is replete with facts which when proven at trial will constitute evidence—both direct and circumstantial—that Defendants entered an anticompetitive agreement to restrict the Relevant Securities”.

The plaintiffs explain that this case is about individual investors who invested their money in the stock market and were stripped of their rights to control their own investments. The traders accuse the defendants and other market players of hatching an anticompetitive scheme to restrict Retail Investors’ access to the stock market and prevent the market from operating freely and fairly.

According to the traders, the defendants did so to protect each other, and to stop the hemorrhaging losses incurred by the Market Maker Defendants as a result of their accumulation of large short positions.

The plaintiffs in this case claim to represent:

All persons or entities in the United States that held shares of stock or call options in GameStop Corp. (GME), AMC Entertainment Holdings Inc. (AMC), Bed Bath & Beyond Inc. (BBBY), BlackBerry Ltd. (BB), Express, Inc. (EXPR), Koss Corporation (KOSS), Nokia Corp. (NOK), Tootsie Roll Industries, Inc. (TR), or Trivago N.V. (TRVG) as of the close of market on January 27, 2021, and sold the above-listed securities from January 28, 2021 up to and including February 4, 2021 (the “Class Period”).

The plaintiffs seek to prove the alleged conspiracy. They note that the industry is close-knit and built on preexisting relationships. Additionally, individuals within the industry frequently move from one market participant to another or invest financial resources in other market participants.

Citadel Securities’s Head of Execution Services, for instance, the plaintiffs say, had prior working relationships through FINRA with Josh Drobnyk, Robinhood’s Vice President of Corporate Communications during the relevant period.

According to the traders, as a result of the close-knit nature of the industry and the prior relationships developed by those within the industry, there are a high number of interfirm communications which tend provide opportunities to exchange information and to render a market susceptible to collusion. Given the events of late 2020 and January 2021, the participants in the conspiracy had numerous opportunities to conspire to restrain trade.

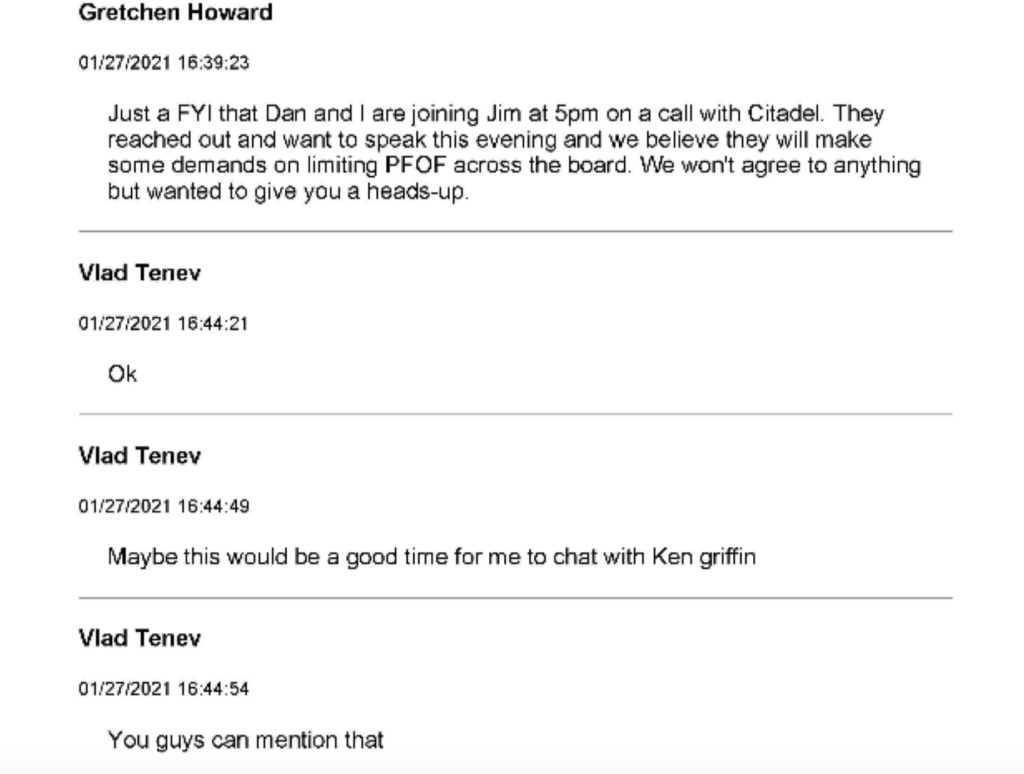

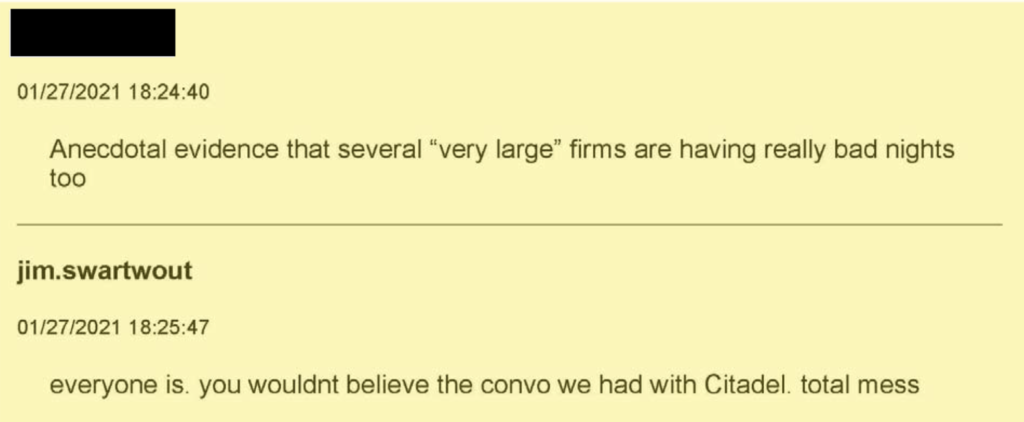

The traders note that high level executives of Citadel Securities and Robinhood coordinated communications in the weeks before, and numerous times the day before, the restrictions were ultimately imposed.

Additionally, Robinhood’s Drobnyk appeared to accept Citadel Securities’s proposition made on January 20, 2021. Also, high level employees of E*Trade and Citadel Securities exchanged communications throughout January 28, 2021 to confirm certain orders were cancelled.

The plaintiffs admit, however, that while high-level employees of Citadel Securities and Robinhood coordinated communications via email or via internal chat channels, the emails appear cryptic with little indication about the subject matter communicated between the participants, reserving substantive discussions of their dealings to unrecorded telephone calls.

On January 27, 2021, the day before the restrictions were implemented, high level employees of Citadel Securities and Robinhood had numerous communications with each other. According to the plaintiffs, this indicates that Citadel applied pressure on Robinhood.

The plaintiffs argue that Citadel Securities stood to gain from stopping the short squeeze by purchasing new short positions at the peak of the Relevant Security price increase and then profiting from the artificial decrease in share price after the trading restriction on January 28th.

The traders say:

“While there is no publicly available data to show that Citadel Securities was one of the parties that opened up new short positions on January 25 – recall there is no requirement that hedge funds disclose their short positions except as described above – it would be in Citadel Securities’s best interest to open up new short positions if Citadel Securities planned to leverage its relationships to halt trading of GameStop and other Relevant Securities and artificially depress their share price”.

Further, according to the traders, given Robinhood relies on payment for order flow for revenue, and sold a significant portion of its order flow to Citadel Securities, the two firms had motive to cooperate due to their close economic relationship. Indeed, in several internal conversations, high level executives of Robinhood and Citadel Securities stated the firms had a “strong relationship” and that the relationship was a “partnership.”

The plaintiffs add that the Clearing Defendants had reason to participate and join in the conspiracy. NSCC is a member driven corporation. Member clearing agents report the trades they receive to their parent organization, the DTCC. The DTCC then ensures the transfer of money to the seller’s broker account and the transfer of security ownership to the buyer’s broker account. To mitigate the risk of settling trades, the DTCC requires that NSCC member clearing firms put up collateral, which the NSCC member clearing firms typically pass down to brokerages.

The DTCC collateral requirement changes depending on the perceived risk of the order, since if one side of the trade defaults, and the broker cannot cover the loss, DTCC member firms are on the hook for completing the trade. In other words, if a member became bankrupt, DTCC and its member clearing agents would be on the hook for the short positions taken by that member.

Robinhood’s CEO Vladimir Tenev also testified before the Congressional House Committee on Financial Services that Citadel Securities’s payment for order flow revenue is Robinhood’s primary source of revenue.

The traders state:

“This essentially proves that Robinhood’s client is not the retail investor themselves, but rather Citadel Securities. In this relationship, it is actually the retail investor who is Robinhood’s product; the product for which Citadel Securities is in fact buying and paying Robinhood a premium.

The traders add that Robinhood is not alone in profiting from payment for order flow. Every Brokerage Defendant, Apex, and ETC sell order flow. Additionally, Citadel Securities is either the largest or one of the largest payors for order flow for most of them”.

According to the plaintiffs, Robinhood and other broker dealers had every motivation to join the anticompetitive scheme to restrict trading to benefit their real clients: the clearing agents and the Market Maker Defendants.

“Robinhood has gamified the investing market to funnel young investors onto their platform, ultimately to offer the Market Maker Defendants a birds’ eye view of both sides of their trades, enabling companies like Citadel to benefit from simultaneously making and playing the market” – the traders argue.

The lawsuit continues at the Florida Southern District Court. The amended complaints just filed by the plaintiffs will be discussed by the parties at a status conference scheduled for September 23, 2021.