Electronic trading major IG Group Holdings plc (LON:IGG) has just reported a set of solid results for the financial year ended 31 May 2021.

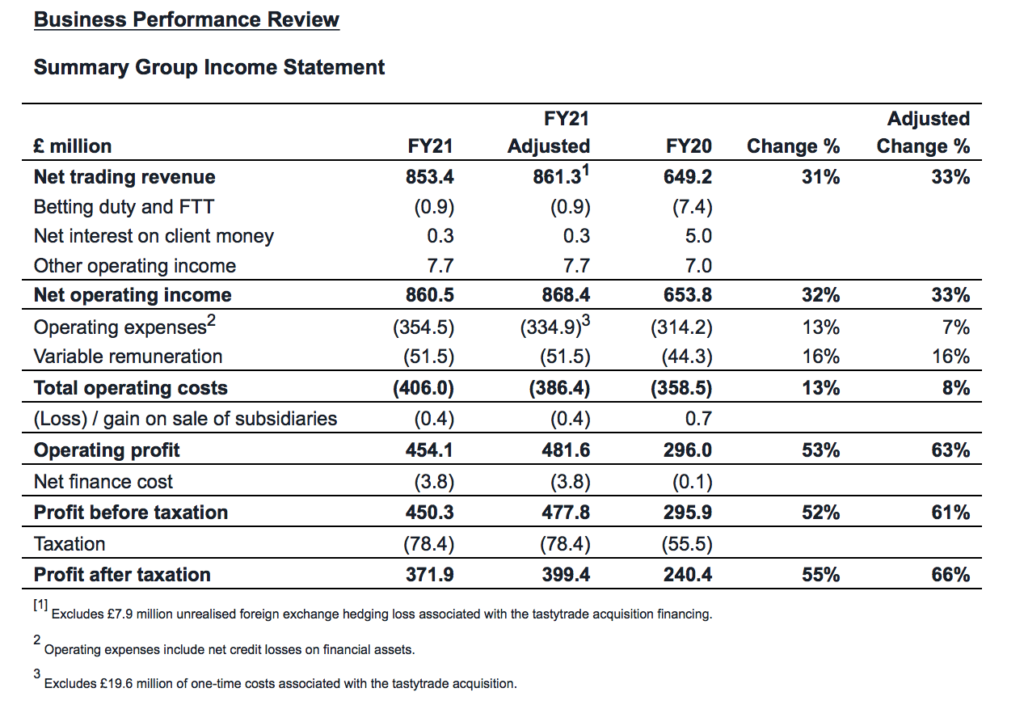

Net trading revenue for FY21 was up 31% year-on-year to £853.4 million (FY20: £649.2 million). Excluding one-time hedging costs associated with the financing of the tastytrade acquisition, adjusted net trading revenue was £861.3 million.

Total active clients rose 31% to 313,300 (FY20: 239,600) and new clients onboarded rose 39% to 134,800 (FY20: 96,900). IG now services a substantially larger client base going into FY22.

FY21 OTC leveraged revenue was £798.2 million, 29% higher than FY20, reflecting a 22% increase in the number of active OTC leveraged clients and a 6% increase in the average revenue per client.

There were 216,300 active OTC leveraged clients in FY21. During the extreme market volatility in Q4 FY20, the Group onboarded a significant number of new clients, many of whom continued to trade throughout FY21. New client acquisition continued to be strong throughout FY21, with an additional 85,100 new active clients onboarded, a 19% increase on FY20. New OTC leveraged clients generated £162.5 million in revenue compared with £125.3 million in FY20, an increase of 30%.

Average revenue per client was £3,690, 6% higher than FY20, reflecting an increase in the level of client trading, noting that FY20 was heavily skewed by the significant increase in trading in Q4, whereas average revenue per OTC leveraged client has been steady across each quarter of FY21.

Revenue from stock trading and investments was £38.7 million in FY21, up 184% on FY20, reflecting a 63% increase in the number of stock trading clients served by the Group and a 74% increase in the average revenue per client.

Throughout FY21 the stock trading client base grew each month driven by a significant and sustained increase in new active clients, with 51,400 onboarded, an increase of 98% on FY20.

Revenue from exchange traded derivatives in FY21 was £24.4 million, 33% higher than FY20. Of this, £19.5 million was from Nadex, the Group’s US retail-focused exchange, an increase of 10% on FY20. This was driven by a 28% increase in the number of active clients, with average revenue per client down 14%.

Spectrum, the pan-European multilateral trading facility (MTF) which launched in October 2019 (FY20), delivered £4.9 million revenue compared with £0.6 million in FY20. During FY21, 3,800 new clients were onboarded, an increase of 44% on FY20.

UK and EU revenue in FY21 was £420.1 million, 28% higher than in FY20. The significant increase in revenue was driven by the 18% increase in the number of active clients trading, the result of good retention of the existing client base and the acquisition of 39,900 new active clients in the period, 17% higher than FY20.

The revenue increase was most significant in IG’s retail client segment, driven by record new client acquisition, resulting in an 18% increase in active clients and a 29% increase in the average revenue per client. IG’s professional client segment also saw a 5% increase in active clients and a 2% increase in revenue per client.

Revenue from Australia increased by 36% to £119.7 million, benefitting from a 12% increase in the active client base, and a 21% increase in revenue per client. In FY21 we acquired 10,100 new clients, an increase of 9% on FY20. On 29 March 2021, the Australian Securities and Investments Commission (ASIC) leverage restrictions were introduced. The impact on revenue in the last two months of FY21 was in line with expectations.

Singapore revenue was £74.5 million, 31% higher than FY20, reflecting a 12% increase in the number of active clients and a 17% increase in revenue per client. Acquisition was strong with 4,300 new clients onboarded, an increase of 5% on FY20.

EMEA non-EU revenue, which includes the Group’s offices in Switzerland, Dubai and South Africa, was £56.5 million, 5% higher than FY20, with an 8% increase in active clients and a 3% reduction in revenue per client. Performance in this region, particularly in Switzerland and Dubai, is more concentrated in a small number of higher-value clients, and these markets did not see the same benefit from the increased new client demand and increased client activity as the broader Core Markets businesses.

The Board have proposed a final dividend of 30.24 pence per share, which would maintain the Group’s full-year cash dividend for FY21 at 43.2 pence per share as guided previously.