FNG Exclusive Analysis… Following a banner 2020 year which saw shares of publicly traded Retail FX and CFD brokers soar by more than 200%, things were more muted in 2021, although still generally positive.

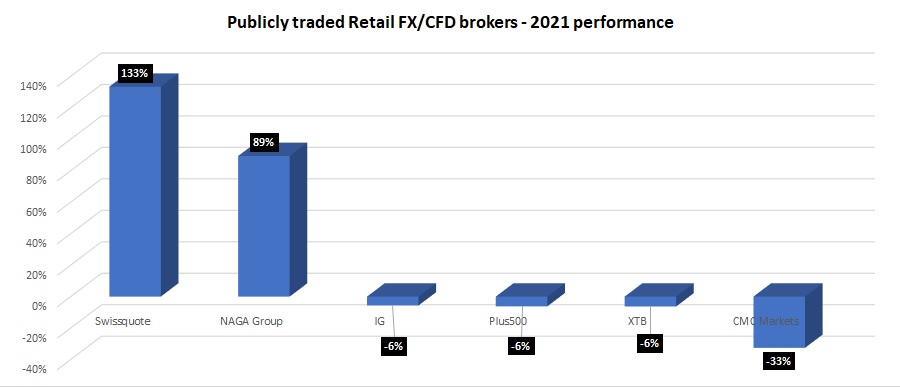

On average, shares of Retail FX brokers were up by 29% in 2021. However that figure (as stats often can be) is somewhat misleading. For the data and statistics nerds out there (self-confessed!), the median return was actually negative, at -6%. What that means is that the +29% “average” was heavily skewed, by one or two firms posting outsized returns, while the majority of brokers were in the red.

And that is exactly what happened in 2021.

The big winners, as far as share price goes, were Swissquote (SWX:SQN) and Naga Group (FRA:N4G). Gland, Switzerland based Swissquote had a phenomenal 2021, reflected by its shares more than doubling in value, rising by 133% to close at CHF 200.50. Swissquote now has a market capitalization of CHF 3.1 billion (USD $3.4 billion), second only in the group to IG’s $4.8 billion valuation.

Not far behind was Hamburg, Germany based NAGA which operates CySEC licensed naga.com. NAGA burst onto the scene in 2020 with a 600% rise in share price. The company continued that momentum into 2021 posting an 89% return for its shareholders, as NAGA raised more than €64 million in additional capital during the year, and posted record revenues. If you bought $1,000 worth of NAGA Group shares on January 1, 2020, today they’d be worth $13,421 – a more than 13x return.

The rest of the group – IG, Plus500, XTB and CMC Markets – posted negative returns for the year, with IG, Plus500 and XTB shares each down 6%, and CMC off 33%.

The returns should of course be taken in the context of an overall very good year for equity markets in general. The broad US S&P 500 stock index was up 27% in 2021, while in the UK the FTSE 100 rose by 14%.

Some more data on the publicly traded Retail FX brokers in 2021:

| Share Price as of… | Mkt Cap | |||

| 1-Jan-21 | 1-Jan-22 | % change | (USD $M) | |

| Swissquote | 85.9 | 200.5 | 133% | $ 3,357 |

| NAGA Group | 4.04 | 7.65 | 89% | 364 |

| IG | 862 | 813 | -6% | 4,760 |

| Plus500 | 1450 | 1360.5 | -6% | 1,820 |

| XTB | 17.9 | 16.78 | -6% | 485 |

| CMC Markets | 391 | 263.5 | -33% | 1,009 |

| Average return | 29% | |||

| Median return | -6% | |||

Note that share prices are stated in the currency listed. Market Cap stats converted to USD.