Israeli business news source Calcalist is reporting that the going-public plan for Retail FX, CFDs, and crypto broker eToro via a merger with special purpose acquisition company (SPAC) Fintech Acquisition Corp V (NASDAQ:FTCVU) is in trouble – at least in its current format.

According to Calcalist, the eToro-SPAC deal is unlikely to be completed in the few remaining business days of 2021, and that – combined with the trouble eToro’s main comparable / competitor Robinhood is having – is putting the deal itself in jeopardy. The current agreement is to see eToro merge with the SPAC at an implied valuation of $10 billion for eToro. The deal includes an injection of an additional $650 million in capital from a group of private equity investors (ION, Softbank, Third Point, Fidelity, Wellington), and a $300 million secondary share sale by company insiders and existing shareholders.

First, the timing issue.

The eToro-SPAC deal was first announced in March 2021, nearly nine months ago, at a time when SPACs were hot and on-the-rise on Wall Street, with the deal aiming to be complete by Q3-2021. (We had exclusively reported in late September that the target date for completion of the eToro IPO was delayed to Q4). However if the agreement spills into 2022 uncompleted, the private investment group can pull their $650 million equity commitment without penalty.

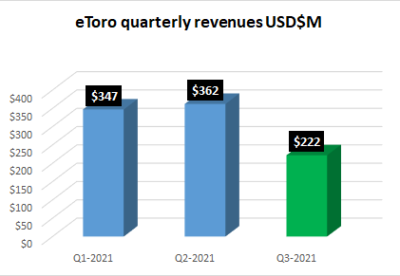

With valuations down significantly in the sector (more on that below), and eToro’s own reported results falling dramatically in the second half of 2021, Calcalist believes that those sophisticated investors are likely to do just that – or at least demand a renegotiated deal, at a much lower valuation.

Similarly, the Fintech Acquisition SPAC investors. Those shareholders are not yet really committed to the deal, which they still need to vote to approve. A smaller / renegotiated deal, unless they get a better “cut” in such a new transaction, is also at risk of being rejected by the SPAC shareholders, in favor of them just getting their money back. As the SPAC market has cooled, an increasing number of SPACs are being redeemed, with the SPAC shareholders just getting their cash back, instead of a merger deal with a private company getting done.

But the real issue is valuation – it almost always comes down to valuation in both the IPO and SPAC markets.

Robinhood share price IPO to Dec 10 (per Google)