Euronext NV (EPA:ENX) has just reported its financial results for the third quarter of 2021, with FX revenues continuing to slide.

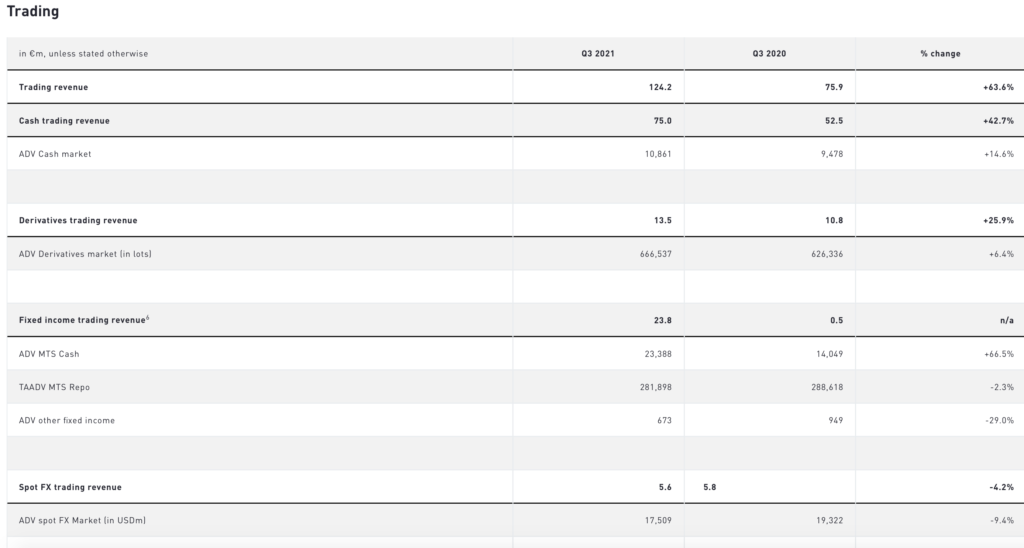

FX trading reported revenue amounted to €5.6 million in the third quarter of 2021, down 4.2% from the equivalent quarter in 2020, reflecting lower trading volumes as FX markets recorded a low volatility quarter. The result was also lower than the €5.7 million in FX trading revenue posted for the second quarter of 2021.

Over the third quarter of 2021, US$17.5 billion average daily volumes were recorded, down 9.4% compared to Q3 2020.

On a like-for-like basis at constant currencies, Spot FX trading revenue was down 3.4% in Q3 2021 compared to Q3 2020.

On the brighter side, derivatives trading revenue increased by 25.9% to €13.5 million in Q3 2021 as a result of the consolidation of Borsa Italiana derivatives trading activities and of a record third quarter for commodity derivatives trading.

During the third quarter of 2021, average daily volumes on financial derivatives was 583,691 lots, up 3.4% from Q3 2020 reflecting a low volatility environment for equity derivatives, while average daily volumes on commodity derivatives was 82,846 lots, up 34.4% from Q3 2020 reflecting successful geographical and client expansions.

Euronext revenue capture on derivatives trading was €0.31 per lot for the third quarter of 2021.

Across all segments, in the third quarter of 2021, Euronext consolidated revenue and income increased to €350.6 million, up 71.2%, primarily resulting from (i) the first full quarter of consolidation of the Borsa Italiana Group and from (ii) double digit organic growth especially in listing, trading and clearing activities, partially offsetting lower custody and settlement activity.

Operational expenses excluding depreciation & amortisation increased to €147.6 million, up 69.5%, primarily as a result of the consolidation of the costs from the Borsa Italiana Group, VP Securities (until 4 August) and 3Sens (part of Corporate Services) for €54.8 million, as well as integration costs. On a like-for-like basis, operational expenses excluding depreciation & amortisation increased by 5.3% compared to Q3 2020.

Consequently, EBITDA for the quarter was up at €203.0 million, representing an EBITDA margin of 57.9%, up 0.4 points compared to Q3 2020, despite integration activity. On a like-for-like basis, EBITDA for Q3 2021 was up 13.7%, to €128.9 million, and EBITDA margin was 60.4%, up 1.8 points compared to the same perimeter in Q3 2020.

Euronext recorded €2.0 million of exceptional costs in Q3 2021, mainly related to the Borsa Italiana Group transaction acquisition.

Net financing expense for Q3 2021 was €7.3 million compared to a net financing expense of €3.4 million in Q3 2020. This increase results from the costs of the newly issued debt in relation with the financing of the acquisition of the Borsa Italiana Group.

As a result, the reported net income, share of the parent company shareholders, for Q3 2021 increased by 64.9% compared to Q3 2020, to €115.8 million. This represents a reported EPS of €1.08 basic and fully diluted in Q3 2021, compared to €0.92 basic and fully diluted in Q3 2020. The number of shares used was 92,447,841 for the basic calculation and 92,678,838 for the fully diluted calculation.

In the third quarter of 2021, Euronext reported a net cash flow from operating activities of €213.5 million, compared to €71.7 million in the same quarter in 2020, reflecting higher positive changes in working capital. Excluding the impact on working capital from CC&G and Nord Pool CCP activities, net cash flow from operating activities accounted for 86% of EBITDA in Q3 2021.