FNG Exclusive… During a year which saw many of its competitors report record trading volumes, revenues and profits, ADS Securities London Limited – the FCA regulated UK arm of UAE-based FX broker ADSS – went in the opposite direction.

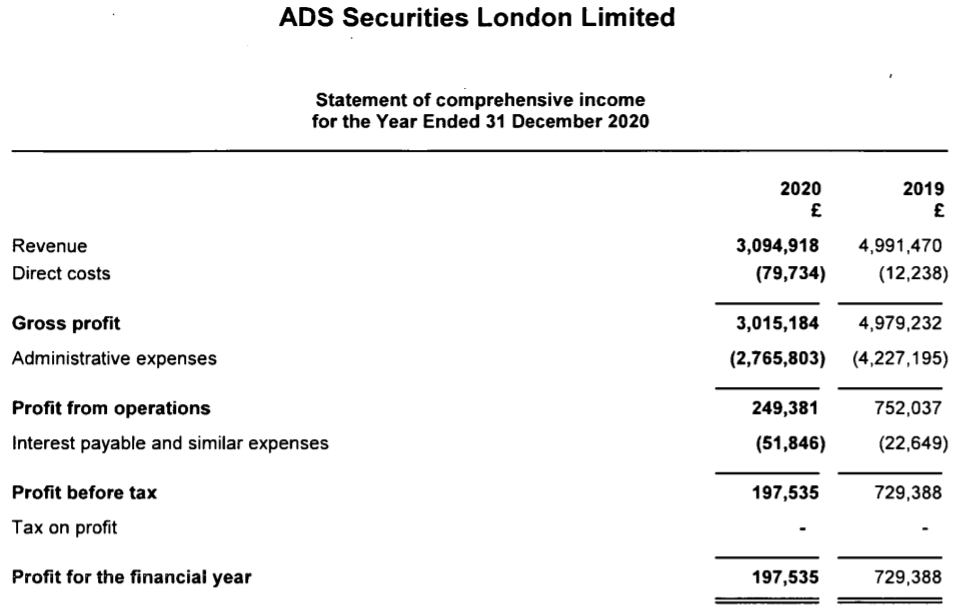

FNG has learned via regulatory filings that ADSS UK saw a 38% decline in Revenues in 2020, £3.09 million versus £4.99 million the prior year (and that was after a 44% decline in 2019). Net profit for 2020 amounted to £197,535, versus £729,388 in 2019.

The company said that the decrease in revenues was a result of the pivot from an institutional led offering to that of one centered around Professional clients. No material impact was seen as a result of Brexit. The board remains committed to its strategy of predominantly focusing upon the Professional client sector within the UK in the short to medium term.

As noted in our headline, however, the decrease in business at ADSS UK came hand-in-hand with a fairly large amount of senior management turnover in the ADSS Group globally as well as in the UK. ADSS UK CEO Paul Webb left the company in mid-2021, as was exclusively reported here at FNG, and moved over to rival Equiti Capital. Global Head of Sales Jason Hughes left in 2020 and joined Exinity. Also departing ADSS in recent months are:

- Oliver Hallsworth, General Counsel and Global Head of Legal & Compliance since 2016.

- Fabian Chui, Head of Front Office and with ADSS since 2017.

- Poul Gotterup, with ADSS since 2014, most recently as Head of Data and Analytics.

- Francis Lee, CEO of ADSS Asia since 2015. We understand that Mr. Lee’s departure will coincide with the planned closure of the ADSS entity in Hong Kong, later this year.

Despite the decline in activity, ADSS UK did see a significant increase in client assets, coming in at £14.3 million at year end 2020 versus £3.5 million the previous year.

ADSS UK was established to provide a range of brokerage and trading services to the UK market. The company provides contracts for difference, including Spread bets to retail, professional and institutional clients. The company acts in the capacity of a principal deal firm that faces the client (whilst interacting with ADS Securities LLC, an Abu Dhabi based brokerage firm).

Looking forward, ADSS UK said that a key focus of the business strategy for 2021 is growing and diversifying the client base; for the professional client segment the key focuses are around a personalised and experienced sales trading service supplemented by competitive pricing and execution. The institutional focus is based on enhancing current technology and leveraging on non-bank liquidity which provides a USP, and the firm is set to recommence marketing and sales activity with retail classified clients in Q3 of 2021.

The ADSS Group is currently undergoing a transformation program and is looking to enhance all areas of the business. This includes the development of a new trading platform that is expected to be operational in ADS Securities London Limited in the second half of 2021. In the future, learnings from the Covid-19 pandemic will be considered and this may impact future working patterns, possibly with a greater shift toward agile working arrangements.

ADSS, via its parent company ADS Holding LLC, is controlled by UAE businessman Mahmood Ebraheem Al Mahmood.

ADSS UK’s income statement for 2020 follows: