The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

Net Zero Emission targets stem from the breakthrough 2015 Paris Agreement, where countries committed to reducing greenhouse gas emissions to keep global temperature increase in the 21st century to under 2 degrees Celsius. The 2021 Glasgow Climate Pact, although a diluted form of the initial proposal, was the first time a major deal between nations acknowledged that fossil fuels are the primary cause of climate change. The acknowledgement led to the adoption of the Net Zero target into many legislative, regulative, and investment policies in the six years between Paris and Glasgow.

Fast forward to 2022. The global economy is struggling to regain its momentum after the pandemic crisis and depends heavily on high emissions for growth. We collectively emit over 50 billion tons of CO2 equivalents annually, over 40% above the emissions in 1990. China, which was expected to spearhead global economies out of the pandemic-led contraction, tops the chart, emitting twice as much as the world’s largest economy, the United States of America. The other emerging BRIC countries (Brazil, India, and Russia) are not too far behind in emissions.

As the efforts towards the Net Zero by 2050 target ramp, what’s the economic impact of scaling back emissions?

What if We Do Nothing?

The impact of doing nothing is a critical consideration in evaluating the impact of Net Zero. Even if economies ignore the devastating human cost, climate change does pose a substantial financial risk. An increase in average global temperatures is already causing erratic weather patterns, rising sea levels, reduced food security, higher health risks, geopolitical conflicts, and the mass displacement of communities.

Over the last 50 years, climate change-related disasters have increased fivefold, causing $202 million in economic damage every day. Insurance Firm SwissRe forecasts a reduction in global GDP by 14% ($23 trillion) by 2050, compared to a world without climate change. That loss is higher than the 2019 GDP of the US, which stood at $21.43 trillion. Bank of America (BofA) analysts estimate a $69 trillion reduction in global GDP if climate change is ignored. The analysts believe that this could wipe out $2.3 trillion of equity value by 2100.

On the other hand, there are significant costs associated with meeting the Net Zero target.

Economic Impacts of the Transition

The Net Zero by 2050 target has been set by more than 70 countries, covering 76% of global emissions. Most have chosen 2050 as the deadline (China targets 2060). The EU has pledged to become the first carbon-neutral continent. If followed, the investments to fulfil these pledges come at a significant price tag.

There are seven energy and land-use systems that create the world’s CO2 and methane emissions:

· Power

· Industry

· Mobility

· Buildings

· Agriculture

· Forestry

· Waste

The most exposed sectors to divestment are high-level emission production or operations such as:

· Steel

· Cement

· Oil & gas

· Agriculture

Investment in more efficient production and the transition to renewables will reduce demand for these sectors and reshape the supply mix.

Changing Opportunities

According to McKinsey, capital spending on physical assets will amount to $275 trillion during the transition period, or $9.2 trillion a year. The current annual capital spending lags the target amount by $3.5 trillion. This represents a massive investment opportunity for companies. The increase equals around half the global corporate profits recorded in 2020.

Estimates vary, however. While considering total investments (rather than just in physical assets), the IMF estimates a cumulative increase of $20 trillion, while Reuters’s economists suggest $44 trillion. The capital spending and fiscal support need to be front-loaded funded between now and 2030.

Estimates indicate a steep decline in the demand for fossil fuels during the transition, with a complete halt in coal, a 55% reduction in oil and a 70% in gas demands. Renewables and nuclear power will replace fossil fuels. Goods that contain carbon, such as plastics, will drive the demand for petroleum.

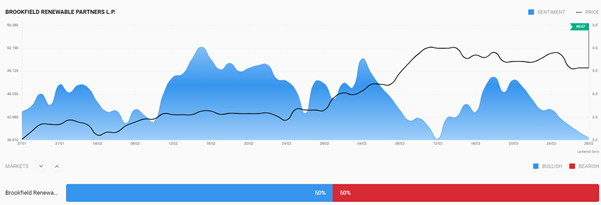

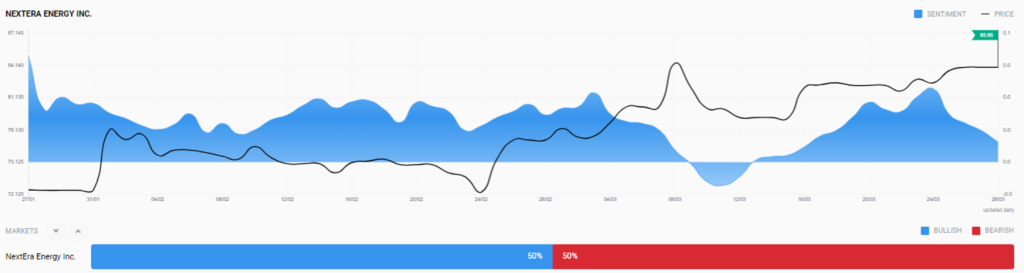

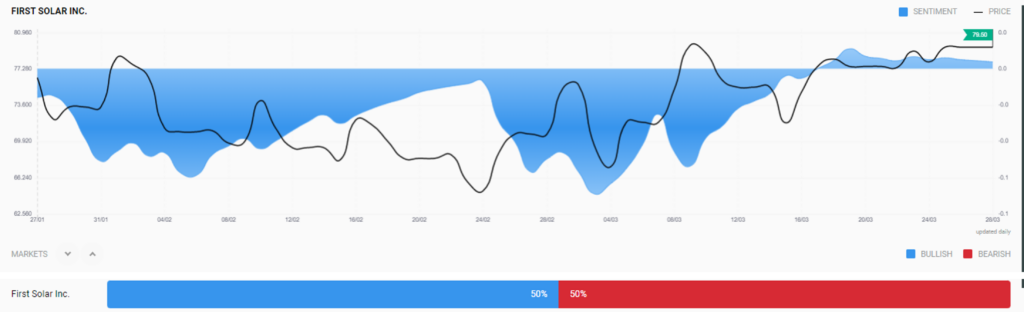

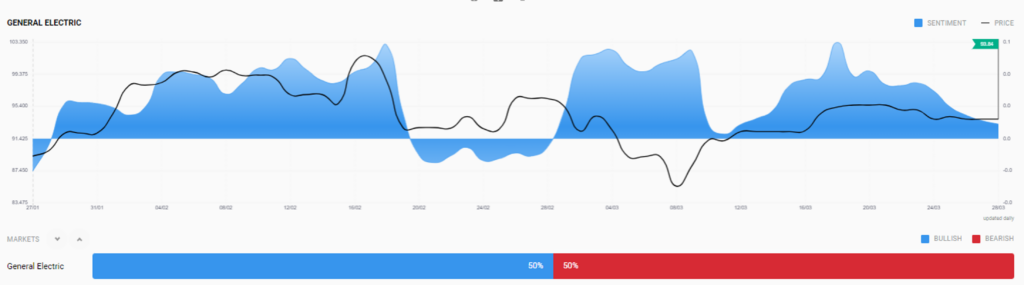

Jobs in the fossil fuel power sector are expected to be 60% lower but estimated to be replaced and surpassed by millions of jobs in renewable power. BofA forecasts 42 million green jobs under a $5 trillion per annum increase in investments. The increased investment offers considerable opportunities in new high-growth green sectors. The market sentiment for renewable energies is balanced, according to Acuity’s Sentiment Widget.

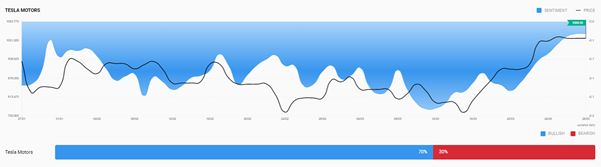

For Automobiles, demand is expected to shift almost entirely to EVs and fuel-cell cars during the transition period, led by public transport and subsequently automobile ownership.

Companies will also have new sectors to explore in de-carbonising or low-emission products, new green products and support offerings such as lithium and cobalt mining. BofA also expects increased annual investment in moon-shot technologies of $2 trillion that will come to fruition by 2050 to achieve goals.

An attractive market for carbon will also increase investment opportunities. Only 20% of world carbon is covered by carbon credits or taxes, leading to significant under-pricing compared to emission targets. Increases in carbon pricing and production cost could cause inflation, but new technologies are likely to boost GDP enough, creating slack to absorb moderate inflationary pressures. Carbon taxes in Canada and Europe have, in the past, reduced household demand and lowered prices.

The Net Zero transition puts the global economy on the road to more sustainable productivity, generating value in new and existing technologies and operations, while keeping away the decimating forces of climate change. The result is a more resilient and deeper economy that has considerably reduced one of its most exigent risks. On the other hand, there are caveats. The projections by experts are mostly based on a stable and coordinated global transition, and there are risks related to weather event disruptions if the transition is delayed. Currently, none of the Paris or Glasgow signatories is on course to meet targets. If the transition is not given enough time, there can also be instability from labour market disruptions.