Bank of America Corp (NYSE:BAC) has just posted its financial report for the final quarter of 2021, with the Global Markets business segment marking a drop in net income.

For the three months to December 31, 2021, the Global Markets segment of Bank of America reported net income of $669 million, $122 million lower than a year ago. Excluding net DVA, net income decreased 20% to $667 million. The result was weaker than the Global Markets net income of $926 million registered in the third quarter of 2021.

Global Markets revenue for the final quarter of 2021 was $3.8 billion, down 2% year-on-year, due to lower sales and trading results. Excluding net DVA, revenue decreased 4% from the year-ago quarter.

FICC revenue declined to $1.6 billion, reflecting a weaker credit trading environment, whereas equities revenue increased to $1.4 billion, driven by growth in client financing activities.

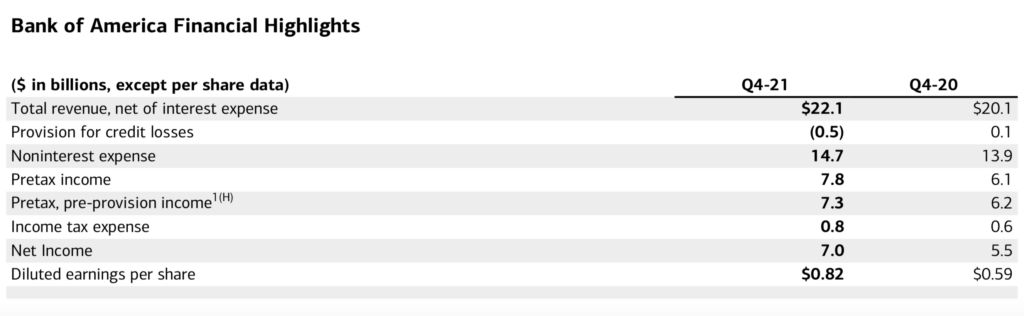

Across all segments, net income rose 28% to $7.0 billion, or $0.82 per diluted share, reflecting strong operating leverage as revenues grew faster than expenses.

Revenue, net of interest expense, increased 10% to $22.1 billion.

Chairman and CEO Brian Moynihan commented:

“Our fourth-quarter results were driven by strong organic growth, record levels of digital engagement, and an improving economy. We grew loans by $51 billion and added $100 billion of deposits during the quarter, further strengthening our position as the leader in retail deposits.

We earned a record $32 billion in 2021, with every business line solidly contributing. Wealth Management had record client flows and the strongest client acquisition numbers since before the pandemic. Investment Banking had its best year ever and Global Markets had its highest sales and trading revenue in a decade, led by record Equities performance as we invested in the business”.