A new study by the Autorité des Marchés Financiers (AMF) confirms the renewed interest of retail investors in the financial instruments under its jurisdiction. Usually dominated by traditional banks and online brokers, stock market investments by retail investors are increasingly being made via neo-brokers.

This study covers 218 million transactions executed between the third quarter of 2018 and the third quarter of 2021 by French and foreign retail investors on financial instruments for which the AMF is the competent authority of the most relevant market in terms of liquidity.

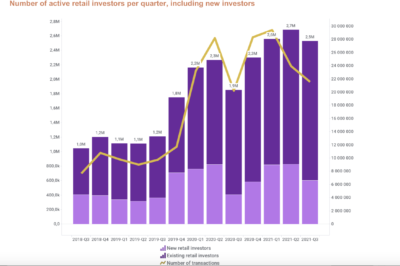

While the number of active investors per quarter stagnated around one million until the third quarter of 2019, a first large intake of new investors is noted in the fourth quarter of 2019, related to the initial public offering of Française des Jeux.

Since the health crisis, equally large intakes of new retail investors then increased the overall number of retail investors active in the markets, in a context marked by lockdowns and increased teleworking.

This affinity for financial markets remained uninterrupted by the resumption of work with physical presence in a period of higher financial market volatility, because the number of active retail investors has doubled since 2020 and has remained at high levels (more than 2.5 million).

Moreover, the growth in the number of incumbent and new investors, compared with growth in the number of transactions for these categories of investors, shows that the new investors perform proportionally fewer transactions than incumbent investors.

Equity transactions account for 75% of the total number of transactions. This figure reaches 85.5% if transactions in Exchange Traded Funds (ETFs) are included. All the instruments classified as “non-complex” in this study (equities and share rights, ETFs and bonds) account for 87.5% of the transactions performed by retail investors. However, it is interesting to note that the ETFs most often traded by retail investors are those offering an index leverage effect, which is a sign of retail investors’ use of higher-risk products.

In contrast, only a small number of transactions are performed on bonds and other debt products.

The remaining 12.5% of transactions are mostly transactions on equity derivatives, with a majority of Contracts For Difference (CFDs) and warrants.

Between the third quarter of 2019 and the third quarter of 2021, each category of institution’s active client base increased from 712,600 active clients to more than 1,200,000 clients for traditional banks (+68%), from 214,600 active clients to more than 520,500 clients for online banks (+142%), and from 68,000 active clients to more than 409,400 clients for neo-brokers (+502%).

However, it should be noted that the sharp increase in traditional bank’s clients in the fourth quarter of 2019 can be explained mainly by the initial public offering of Française des Jeux, which attracted a large number of new investors exclusively via traditional banks and online banks, since participation in this IPO was not offered to clients by neo-brokers.

The population of active investors has become significantly younger since the third quarter of 2018 regardless of the category of institution considered.

The fall in the average age of the broad population of active investors is even more pronounced due to the increase over time in the number of neo-broker clients, who have always been significantly younger than the clients of the other categories of institutions, with an average age of 36.8 years at present.