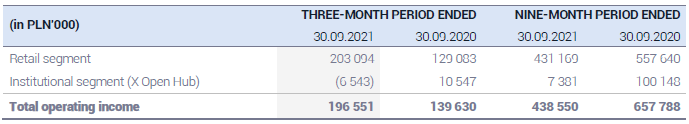

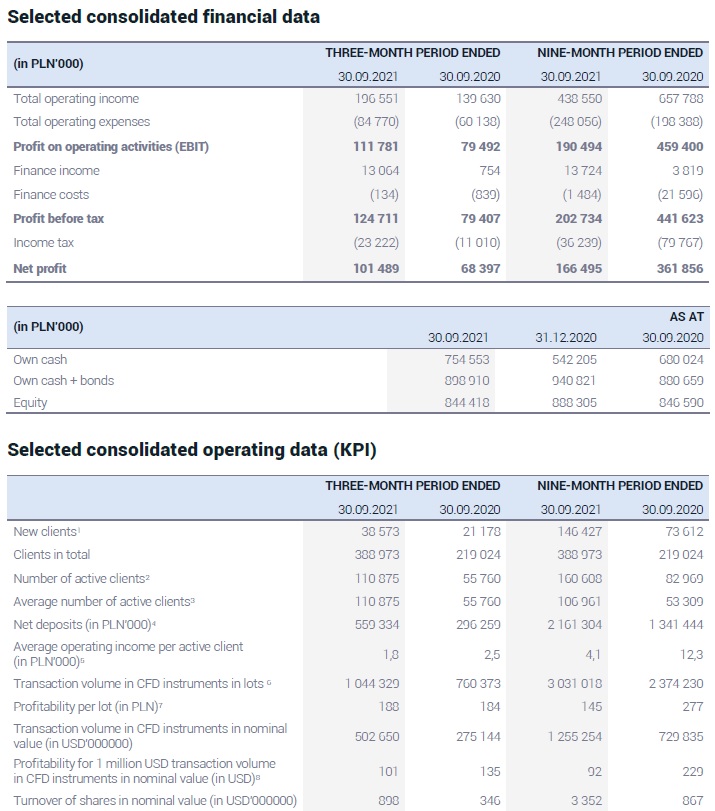

Poland based Retail FX and CFDs brokerage group XTB (WSE:XTB) has reported its financial results for Q3-2021, indicating that the company bounced back nicely from what was a very disappointing Q2 at XTB.

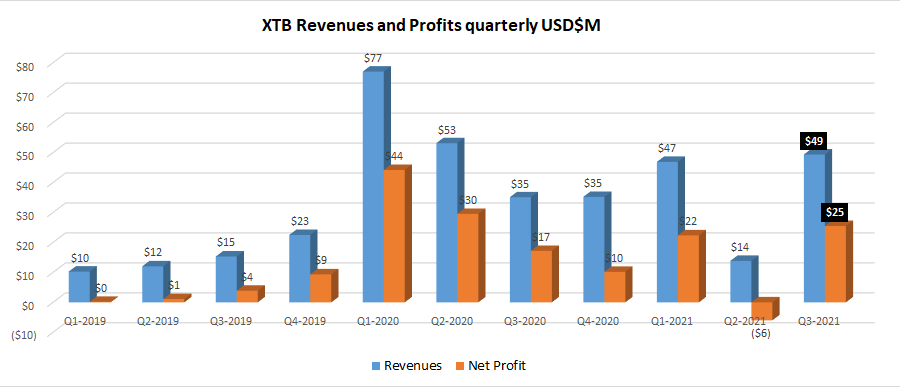

In Q3, XTB reported Revenues of PLN 196.6 million (USD $49 million) and Net Profit of PLN 101.5 million ($25 million) – much improved over the $14 million in Revenue and a loss of $6 million the company saw in Q2. This was in fact XTB’s best quarter since Q2-2020, where trading volumes expanded greatly at the outset of the global Covid-19 pandemic in the face of soaring financial market volatility.

Amounts in graph translated based on 1 USD = 3.98 PLN.

Client CFD trading volumes averaged $168 billion monthly at the company’s XTB.com brand in Q3, much improved over the company’s $125 billion average volume during the first six months of the year.

Looking at revenues in terms of the classes of instruments, CFDs based on commodities dominated. Their share in the structure of revenues on financial instruments in the third quarter of 2021 reached 59.2% against 22.9% a year earlier. This is a consequence of high profitability on CFD instruments based on gold, silver and natural gas. The second most profitable class were CFD instruments based on indices. Their share in the structure of revenues in Q3-2021 reached 22.9% (2020: 52.0%). The most profitable instruments among this asset class were CFDs based on the US 100 and US 500 indexes. Revenues of CFD based on currencies reached 14.4% of all revenues, compared to 20.1% a year earlier, where the most popular financial instruments in this class were based on the EURUSD currency pair.

XTB said that it has a solid foundation in the form of a constantly growing client base and the number of active clients. This is the key to the amount of recurring income in the future. From the beginning of the year, the Group reported another record in this area, acquiring 146,427 new clients compared to 73,612 a year earlier, an increase of 98.9%. This is the effect of continuing the optimized sales and marketing strategy, bigger penetration of already existing markets, successive introduction of new products to the offer and expansion into new geographic markets. Similarly to the number of new clients, the average number of active clients was also record high. It increased from 53,309 to 106,961, i.e. by 100.6% YoY.

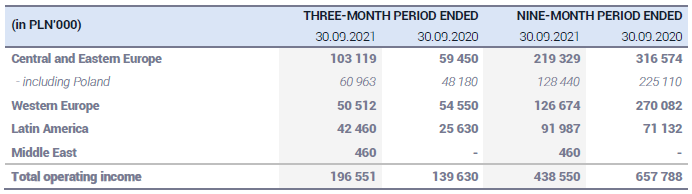

The XTB Management Board added that it puts the main emphasis on organic development, on the one hand increasing the penetration of European markets, on the other hand successively building its presence in Latin America, Asia and Africa. Following these activities, the composition of the capital group may expanded new subsidiaries. It is worth mentioning that geographic expansion is a process carried out by XTB on a continuous basis, the effects of which are spread over time.

Currently, the efforts of the Management Board are focused on expansion into the Middle East and Africa markets. At the end of November 2020, XTB received the preliminary approval of the DFSA (Dubai Financial Services Authority) regulator to conduct brokerage activities in the United Arab Emirates. It was a consent of the principal type, i.e. requiring the fulfilment of conditions (mainly of an operational nature) before the actual start of operations. One of them was the establishment of XTB MENA Limited in DIFC (Dubai International Financial Centre), which took place on January 9, 2021. On July a notification from the DFSA confirming the grant of the license with its effective date on July 8 2021. The official start of operating activities of XTB MENA Limited in the United Arab Emirates took place on July 29, 2021.

On August 10, 2021, the subsidiary XTB Africa (PTY) Ltd. received a license to operate the XTB brand in South Africa. The intention of the Management Board is to start operating in this market in the second half of 2022.

XTB said that it places great importance on the geographical diversification of revenues. The country from which the Group derives more than 15% of revenues is Poland with the share of 31.0% in the third quarter of 2021 (2020: 34.5%). The share of other countries in the geographical structure of revenues does not exceed in any case 15%.

XTB noted that it also puts strong emphasis on diversification of segment revenues. Therefore the Group develops institutional activities under X Open Hub brand, under which it provides liquidity and technology to other financial institutions, including brokerage houses. Revenues from this segment are subject to significant fluctuations from quarter to quarter, analogically to the retail segment, which is typical for the business model adopted by the Group.