The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

We’re finally in taper territory. All market activity across assets and around the world seems to be in response to the US Fed’s tapering plans.

The Fed has been purchasing $80 billion in treasuries and $40 billion in mortgage securities every month since June 2020, while maintaining interest rates at record lows. Of course, the central bank’s balance sheet has exploded, from $4.31 trillion in March 2020 to $8.36 trillion in September 2021. On September 22, 2021, Federal Reserve Chairman Jerome Powell emphasised the need for gradual tapering, aimed to conclude in mid-2022. Provided the country’s economic recovery remains on track, the central bank will go ahead with this plan.

While inflation hawks have been looking to the Fed for tightening, given that US inflation is racing ahead at a pace not seen in the last 30 years, investors are understandably jittery about tapering putting breaks on economic recovery.

When Will the Fed Begin Tapering?

The trigger to begin tapering is most likely to come from the labour market. Although the unemployment rate has eased to 4.8%, the lowest it has been since the pandemic outbreak in the US, the country’s labour market has a long way to go. The latest NFP (nonfarm payrolls) report showed job adds of merely 194,000 in September, which missed market expectation of 500,000 by a wide margin. If the labour market improves significantly, the Fed could begin gradual tapering by the end of the year.

How Will Markets Be Impacted by the Fed’s Tapering?

The effects of a gradual withdrawal of stimulus (aka reduction in bond purchases) will be first felt in the treasury bond and mortgage markets. The last significant taper was in 2013 and shockwaves ripped through the markets.

Can we expect the same reaction this time around? Well, not necessarily. The answers to two questions will guide rates and investors should bear these in mind.

#1: Has the market priced in the taper?

In 2013, quantitative easing (QE) was still a novel tool, and investors really did not have a roadmap to tapering. Markets were surprised (read horrified) by the then-Chairman Ben Bernanke’s “pro-taper” comments to a Congress Committee. Dubbed the taper tantrum, the period marked the dumping of fixed income assets, sending the 10-year real yields from -0.24% in May to 0.80% by December that year. The tight conditions made it harder for the Fed to unwind support.

Fast forward to 2021 and investors have been expecting the Fed to taper since inflation picked up in April. This is reflected in the rise in nominal 10-year yields from 0.96% on January 1 to 1.50% on October 12. UBS analysts expect the rate to hit 1.8% by yearend. There was a 23 basis point jump in the week following Fed Chairman Powell’s hawkish comments.

There’s another potent factor looming. The fiscal debt ceiling. The Congress is still in a bitter political battle over the extension and prolonged uncertainty around this could weigh on markets.

#2: How much leeway does the Fed have to taper?

Lower negative real rates give central banks more leeway to taper. Although real 10-year rates peaked in March 2021, at 0.62%, inflation has since driven them down to -0.94%. In 2013, inflation was tepid at best. In 2021, it provides a significant headwind to real rates so that the real cost of borrowing can remain relatively low, even as the Fed removes its purchasing support. Low real cost of borrowing is an advantage for companies and triggers economic activity.

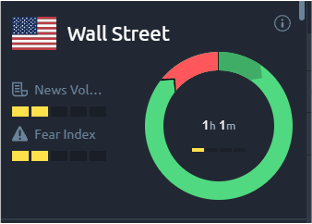

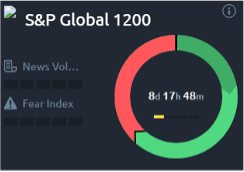

Despite the possibility of tapering in the near term, the sentiment for US stocks remains positive, as can be seen in the Acuity Trading Dashboard.

A Look at the Impact of the Fed’s Tapering on Emerging Markets

In 2013, the taper tantrum was also unfortunate for emerging markets. Rising US real yields hit these markets in two ways. Firstly, they drew capital away from emerging markets. Secondly, the appreciating US dollar increased the dollar-denominated debt of emerging markets. In some cases, the emerging markets were forced to implement detrimental higher rates to protect their currencies and debt levels.

In 2013, the taper tantrum was also unfortunate for emerging markets. Rising US real yields hit these markets in two ways. Firstly, they drew capital away from emerging markets. Secondly, the appreciating US dollar increased the dollar-denominated debt of emerging markets. In some cases, the emerging markets were forced to implement detrimental higher rates to protect their currencies and debt levels.

In 2021, the landscape is different since most of these economies have adequate foreign-denominated reserves. So, the taper effect on emerging markets is also expected to be muted compared to 2013.

In 2021, the landscape is different since most of these economies have adequate foreign-denominated reserves. So, the taper effect on emerging markets is also expected to be muted compared to 2013.

How to Play the Fed’s Taper Plans?

No doubt, equities benefit from QE and the gradual withdrawal could have an impact. However, rising bond yields lower the relative attractiveness of equities. While it is hard to separate the effects of QE on the recent bull market from other stimulus efforts, a 2014 Fed Research found that a reduction of 0.25% in 10-year Treasury Yields increases stock prices by 7%. The planned tapering will steadily increase yields and exert pressure on equities.

On the other hand, the benefits from the fiscal policy adopted during the pandemic have already begun to wear off. Despite this, market sentiment remains intact and equities remain elevated.

Markets can take solace in the fact that the Fed will only taper its QE purchases to the extent that it is not detrimental to the economy. Thus far, the central bank has exhibited credibility and markets are likely to trust its guidance.