What is SVK Markets?

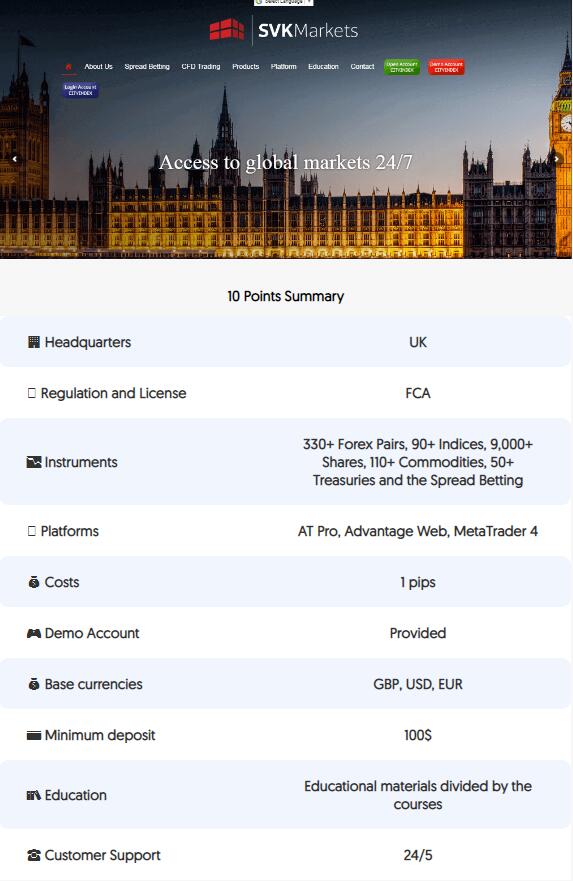

SVK Markets is an established UK brokerage firm which offers advanced investment solutions to the traders and investors of different size to trade CFDs or Spread Betting.

The company incorporated with full compliance and regulation through the local respected authority FCA and acts as an execution only broker while in fact is an introducing broker of City Index.

The broker uses the City Index as their execution provider since they are among the biggest Tier 1 liquidity providers with $474bn average monthly volume Q2 2016 with Global Markets – 12,500 OTC and exchange-traded markets.

SVK Markets Pros and Cons

SVK Markets is a reliable broker with good proposal including various instruments, Spread betting and Shares. There are education, research and range of platforms.

For negative side, spreads are slightly higher and research is rather basic.

s SVK Markets safe or a scam

No, SVK Markets is not a scam, as a UK Based company, SVK Markets is a fully authorized firm by the local authority FCA with low risk trading.

Generally speaking, UK regulation requires to conduct operations are set with the standards of management and service providing. All client funds are fully segregated and are kept in separate bank accounts at Barclay’s Bank PLC, ensuring client money are not used for the company purpose.

Furthermore, SVK Markets registered as a member of the Financial Services Compensation Scheme (FSCS) hence all clients are protected in case of the company insolvency and are covered from the investment loss up to a maximum of £50,000.

SVK markets apply also to the European Markets in Financial Instruments Directive (MiFID) that provides a harmonized environment with financial transparency, competition, and offer greater consumer protection in investment services across the EEA.

Leverage

The leverage levels, which allows trading of bigger size throughout “loan” taken from the broker may significantly increase your trading capabilities, yet you should learn how to use the tool smartly.

The recent updates from the regulatory bodies applied some restrictions towards retail traders on leverage levels, since authorities recognized potential risk on funds losing as well.

Therefore, as the UK regulated firm SVK Markets may offer a maximum of 1:30 for major Forex instruments, and even lower 1:20 for minor currency pairs or 1:10 for commodities.

Instruments

Access to the financial markets at SVK Markets offers 330+ Forex Pairs, 90+ Indices, 9,000+ Shares, 110+ Commodities, 50+ Treasuries and the Spread Betting (a tax-free alternative to conventional trading, yet available for UK clients only). While all can be traded via the range of advanced and technology-driven platforms.

Account types

There is no different account types at SVK markets, is a single account offering.

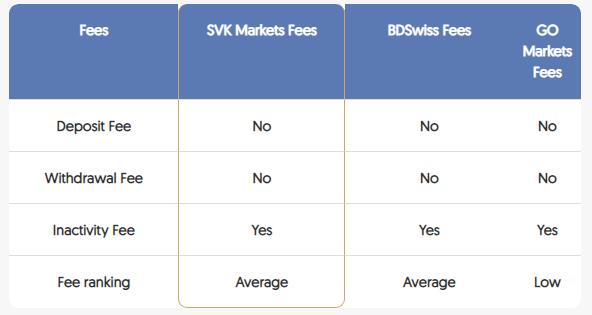

Fees

SVK Markets costs mainly built into a spread, while broker defined its spread on Consistently tight spreads bases. The currency pairs or other instruments are available as a spread bet or CFD trading, margin products that can be accessed out via a full suite of platforms and apps for the traders convenience. While the SVK Market trading costs seem to be an attractive feature, compare its fees to another UK popular broker Pepperstone.

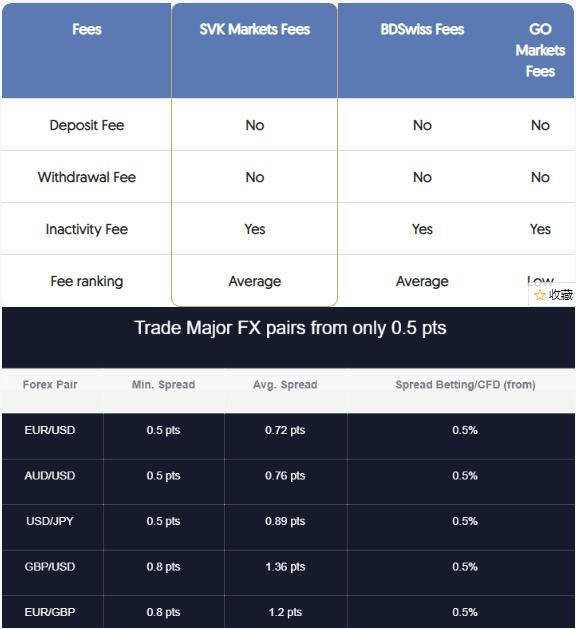

Spread

SVK Markets spreads are 1pt fixed spreads on major FX pairs and indices in hours, tight variable spreads out of hours. The metal spreads start at 2.5 points for Silver and 4 points for palladium, while Gold spread starts from 0.3 points.

The currency pairs or other instruments are available as a spread bet or CFD trading, margin products that can be accessed out via a full suite of platforms and apps for the traders convenience. While the SVK Market trading costs seem to be an attractive feature, compare its fees to another UK popular broker CMC Markets.

Conclusion

Overall, SVK Markets presents a brokerage with the widening range of investment opportunities throughout numerous trading markets, available platforms and powerful tools that allow the performance of potential successful trading. The trading conditions generally quality offering to the global traders with different portfolio and trading style, while the used technology delivers professional and stable trading conditions with an utmost level of security which guarantees clients safety by any means.