Multi-asset trading and investment specialist Saxo Bank is planning some enhancements to its OpenAPI, the backbone of trading platforms such as SaxoTraderGO.

From November 2021, Saxo plans to introduce Extended AssetTypes. To facilitate a better separation of instruments with different properties, Saxo Bank has decided to redefine the AssetType enumeration.

Currently, the developers team will only introduce the new definition for new applications, created after November 1, 2021. At that time the team will also switch the developer portal to work with this new definition.

Extended AssetTypes are created to make the AssetTypes more granular. The AssetType “Stock” contained not only equities, but also different types of funds. The universe became so big over time, creating the need to be more precise, for example when searching for instruments and handling them in a more specific (or correct) way.

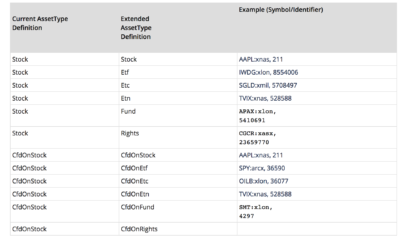

To support this, Saxo have now split the “old” AssetType “Stock” into “Stock”, “ETC” (Exchange-Traded Commodity), “ETF” (Exchange-Traded Funds), “ETN” (Exchange-Traded Notes), “Funds” and “Rights”. Saxo have done the same for their “CFD” equivalents.

When your application calls OpenAPI, the API will check if your application has been configured to work with the new extended AssetType definition. By definition all applications created prior to Nov 1 2021 are configured to operate with the old definition and applications created after Nov 2021 will be created to work with the new definition.

The new asset type definition will be present across all OpenAPI endpoints.

The biggest difference and benefit of switching to Extended AssetTypes will be noted when searching for instruments. Limiting a search to just “Stock” will lead to a smaller search result. To get the old behavior your code will have to provide the full range of the new AssetTypes.

Let’s note that latest version of Saxo’s OpenAPI adds a new service group specifically to support Corporate Actions.

The Corporate Actions service group provides resources to help end clients view and act on corporate actions and proxy votes related to their current holdings.

Corporate Actions are events initiated by companies who are issuers of securities. These events give opportunities to the owners of these securities to receive benefits or take part in certain activities. Holdings are units of shares or other instruments of owners, which are usually the starting point of all the corporate actions. These events could be

- Cash Dividend (DVCA): Distribution of cash to shareholders, in proportion to their equity holding. Ordinary dividends are recurring and regular. Shareholder must take cash and may be offered a choice of currency.

- Dividend Option (DVOP): Distribution of a dividend to shareholders with a choice of benefit to receive. Shareholders may choose to receive shares or cash. To be distinguished from DRIP as the company creates new share capital in exchange for the dividend rather than investing the dividend in the market.

- Conversion (CONV): Conversion of securities (generally convertible bonds or preferred shares) into another form of securities (usually common shares) at a pre-stated price/ratio.

As for 2021, Saxo supports 73 types of events, The /ca/v2/events/eventtypes endpoint returns the full list of available event types.