Investment banking giant Morgan Stanley (NYSE:MS) has just published its financial results for the fourth quarter and full year 2021, with the Institutional Securities segment delivering record annual net revenues of $29.8 billion compared with $26.5 billion a year ago.

Institutional Securities reported pre-tax income of $11.8 billion for FY 2021 compared with $9.2 billion in the prior year.

Investment Banking revenues surged 43% from a year ago, with record advisory revenues driven by higher completed M&A transactions.

Equity net revenues were up 15% from a year ago reflecting strong performance across products and geographies, with notable strength in Asia, driven by higher client engagement.

On the downside, Fixed Income net revenues were down 15% from a year ago due to tighter bid- offer spreads in macro and credit corporates, partially offset by securitized products.

For the fourth quarter of 2021, Institutional Securities reported net revenues of $6.7 billion compared with $7.0 billion a year ago. Pre-tax income was $3.0 billion compared with $3.2 billion a year ago.

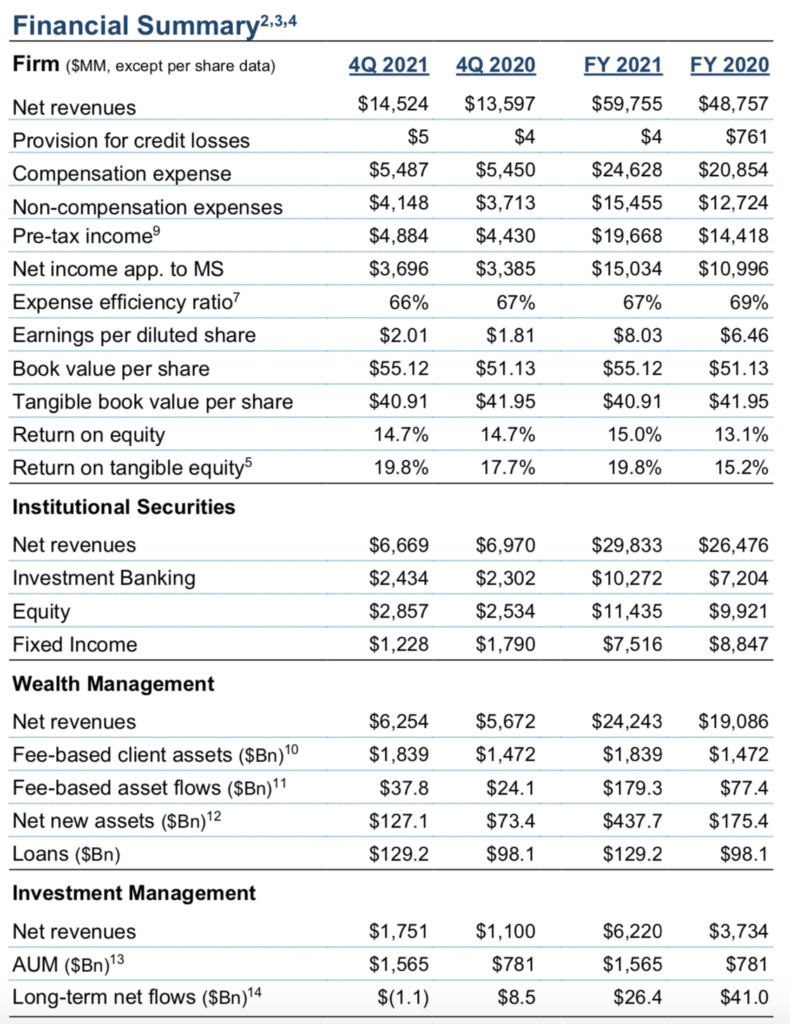

Across all segments, Morgan Stanley reported net revenues of $14.5 billion for the fourth quarter ended December 31, 2021 compared with $13.6 billion a year ago. Net income applicable to Morgan Stanley was $3.7 billion, or $2.01 per diluted share, compared with $3.4 billion, or $1.81 per diluted share,1 for the same period a year ago.

Full year net revenues were $59.8 billion compared with $48.8 billion a year ago. Net income applicable to Morgan Stanley for the current year was $15.0 billion, or $8.03 per diluted share, compared with $11.0 billion, or $6.46 per diluted share, a year ago.

The comparisons of current year results to prior periods were impacted by the acquisitions of E*TRADE Financial Corporation and Eaton Vance Corp.

James P. Gorman, Chairman and Chief Executive Officer, said:

“2021 was an outstanding year for our Firm. We delivered record net revenues of $60 billion and a ROTCE of 20%, with stand-out results in each of our business segments. Wealth Management grew client assets by nearly $1 trillion to $4.9 trillion this year, with $438 billion in net new assets. Combined with Investment Management, we now have $6.5 trillion in client assets. Our integrated investment bank has continued to gain wallet share. We have a sustainable business model with scale, capital flexibility, momentum and growth.”