Equals Group plc (LON:EQLS), a technology-led international payments group focused on the SME marketplace, today provided a trading update for the period from 1 January 2021 to 6 December 2021 (the ‘year to date’) and 1 October 2021 to 6 December 2021 (the ‘Period’).

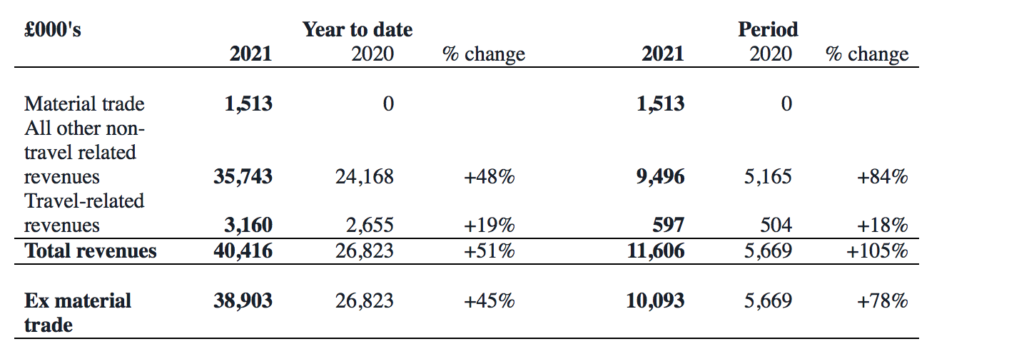

The Group says it has significantly exceeded full-year expectations for both revenues and Adjusted EBITDA. Group revenue for the year to date was £40.4 million compared to £26.8 million for the same period in 2020 – an increase of 51%.

Group revenue for the Period was £11.6 million compared to £5.7 million for the same period last year – an increase of 105%.

As announced on 28 October 2021, both the year to date and the Period benefitted from a material international payments transaction for a large corporate client that generated revenue of £1.5 million.

Underlying revenues rose by 45% over the year to date and 78% in the Period to date. These significant increases have been largely driven by strong demand for the Group’s ‘Equals Solutions’ proposition, the new multicurrency product aimed at larger businesses, which has generated £3.1 million in the year to date and £1.2 million in the Period alone; along with substantial growth in both the Group’s Spend platform and its white-label business.

Revenues from the Group’s B2C travel-money products represented only 5% of total revenue in the Period.

The strong performance in revenues has also underpinned increased gross profits and EBITDA and as such the Group has now exceeded full-year profitability forecasts.

This robust trading performance of the Group further underpins the Board’s confidence in accelerating momentum and maintaining growth moving into the final days of 2021 and into FY-2022. In order to drive further growth the Group continues to re-invest and upgrade the sales functions of the business and this will be reflected in higher staff costs in 2022.

Ian Strafford-Taylor, Chief Executive Officer, commented:

“I am delighted to be able to inform the market that the strong performance we saw in September and October has continued and allowed us to significantly surpass the market expectations for the full year in early December. Our results show the results of strategic steps we undertook three years ago to pivot the business to a B2B-focus and to invest into our platforms and connectivity.”