Credit Suisse today posted its financial report for the third quarter of 2021.

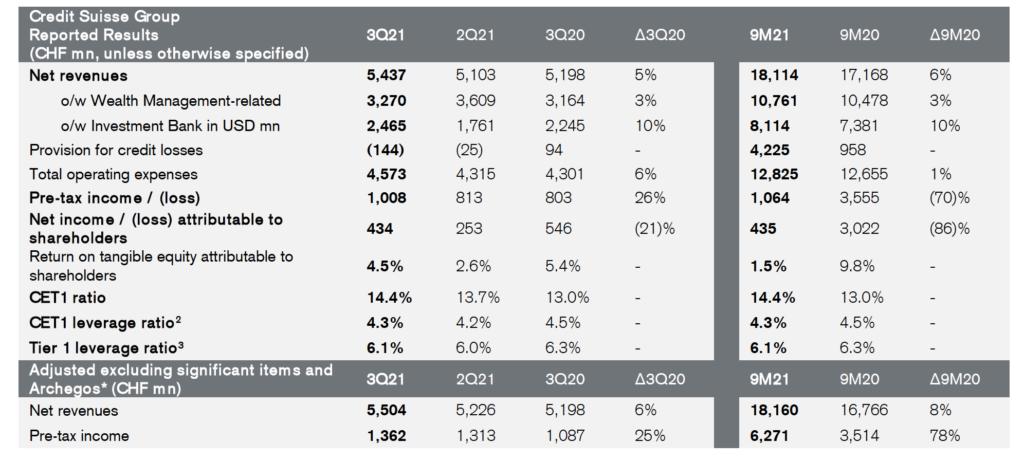

Credit Suisse reported a pre-tax income of CHF 1.0 billion for the third quarter of 2021. The result benefited from a positive impact relating to Archegos of CHF 235 million, mainly due to a release of provision for credit losses pertaining to an assessment of the future recoverability of receivables, and gains on Credit Suisse’s equity investment in Allfunds Group of CHF 129 million.

The rise was partially offset by major litigation charges, including CHF 214 million related to the Mozambique matter as well as provisions for certain other legacy matters, including mortgage-related matters, and in connection with the SCFF matter.

Credit Suisse also recorded a further impairment of CHF 113 million relating to the valuation of its noncontrolling interest in York Capital Management.

Net income attributable to shareholders of CHF 434 million continued to be impacted by a significantly elevated effective tax rate, as previously guided, mainly due to only a partial tax recognition of the Archegos loss.

Wealth Management-related businesses reported net revenues of CHF 3.3 bn, up 3% year on year; on an adjusted basis, excluding significant items, net revenues were up 4%.

Investment Bank delivered a solid underlying performance despite continued discipline in risk and capital management with reductions to RWA and leverage exposure in Prime Services. Net revenues of USD 2.5 bn were up 10% year on year; IB reported results included a release of provision for credit losses of USD 202 mn (CHF 188 mn) as well as a USD 24 mn (CHF 23 mn) benefit to revenues and USD 26 mn (CHF 24 mn) net cost recovery in operating expenses relating to Archegos.

Sales & Trading revenues were down 13% year on year and Equity Sales & Trading revenues, excluding Archegos, were down 9% due to continued de-risking in Prime Services. Excluding Prime Services, Equity Sales & Trading revenues substantially increased driven by robust Equity Derivatives performance and higher Cash Equities results.

Capital Markets revenues were up 14% and Advisory revenues were up significantly, by 182%, year on year. Revenues in Global Trading Solutions, Credit Suisse’s collaboration between the IB and its wealth management businesses, declined, in part due to Credit Suisse’s reduced capital usage and more conservative risk appetite coupled with lower volumes and volatility compared to an exceptional comparable in 3Q20.

Operating expenses for the Group of CHF 4.6 bn increased by 6% year on year, mainly driven by higher litigation provisions and professional services fees; adjusted operating expenses, excluding significant items and Archegos, increased by 2% in part due to continued strategic investments across Credit Suisse’s businesses, including its investments in IT infrastructure, the build out of its mainland China business and the expansion of Private Banking coverage teams in APAC, as well as in risk and controls.

Credit Suisse continued to improve its capital ratios with a CET1 ratio of 14.4% at the end of 3Q21, compared to 13.7% at the end of 2Q21, and a CET1 leverage ratio of 4.3%, compared to 4.2% at the end of 2Q21. Its CET1 and leverage ratios benefitted from strong income generation and risk reduction across businesses.