Well that didn’t take long.

On the heels of a massive $75 million court order against now-defunct binary options and CFD broker AlphaBinary made just a week ago, Australia’s financial regulator ASIC issued what it calls “a product intervention order” imposing conditions on the issue and distribution of contracts for difference (CFDs) to retail clients.

The new rules will come into effect as of the end of March 2021. We’d also note they are not permanent – ASIC will try them out for 18 months before making a decision as to whether or not to fully adopt the new rules.

To be fair, this was actually in the works for quite a while and not purely reactionary to the AlphaBinary case result, with ASIC signaling several times in different ways that it indeed was going to take action and place more limitations on CFD brokers. But it does look like the regulator waited for this particular case to play out and strengthen its own case that something had to be done. What seems to have swayed ASIC even more was its review of what happened to retail traders during the first few volatile weeks of the COVID-19 pandemic earlier this year (more on that below).

ASIC’s actions come close to what the FCA in the UK and ESMA throughout the EU imposed on their FX and CFD brokers in August 2018:

- maximum leverage of 30x on CFDs, with that amount reserved only for Forex major pairs; lower leverage on other instruments, down to just 2x on crypto CFDs (which, incidentally, the FCA recently banned altogether); and

- negative balance protection for retail CFD traders – i.e., you can’t lose more than you deposited with your broker.

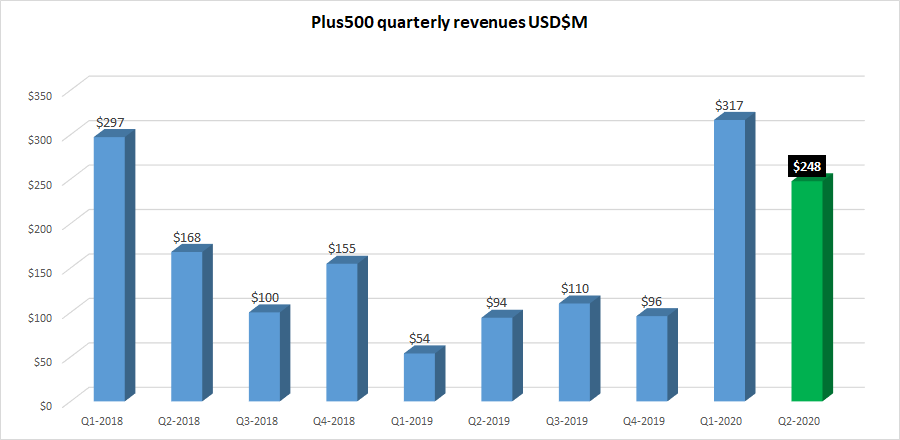

The European regulator actions played havoc with the financials of Retail FX and CFD brokers across the continent, causing a sharp decline in revenues and profitability. An excellent example of that is Plus500, which relies heavily on CFD revenue from UK and European customers. Plus500 saw Revenues decline by more than 50% in the quarters which followed the August 2018 regulator action (although Revenues more than recovered in 2020, as a result of COVID-19 related volatility):

However one rule that ASIC is foregoing is that, unlike in the UK and EU, it will not force CFD brokers to constantly display the risk warning regarding what percentage of traders lose money with that particular broker. Also, ASIC did not ban binary options as part of the new rules – that, however is still under consideration.

ASIC said that its order strengthens consumer protections by reducing CFD leverage available to retail clients and by targeting CFD product features and sales practices that amplify retail clients’ CFD losses. It also brings Australian practice into line with protections in force in comparable markets elsewhere, as we note above.

To the particulars…

From 29 March 2021, ASIC’s product intervention order will:

- restrict CFD leverage offered to retail clients to a maximum ratio of:

- 30:1 for CFDs referencing an exchange rate for a major currency pair

- 20:1 for CFDs referencing an exchange rate for a minor currency pair, gold or a major stock market index

- 10:1 for CFDs referencing a commodity (other than gold) or a minor stock market index

- 2:1 for CFDs referencing crypto-assets

- 5:1 for CFDs referencing shares or other assets

- standardise CFD issuers’ margin close-out arrangements that act as a circuit breaker to close-out one or more a retail client’s CFD positions before all or most of the client’s investment is lost

- protect against negative account balances by limiting a retail client’s CFD losses to the funds in their CFD trading account, and

- prohibit giving or offering certain inducements to retail clients (for example, offering trading credits and rebates or ‘free’ gifts like iPads).

ASIC also confirmed it will not require issuer-specific risk warnings or other disclosure-based conditions as originally proposed in Consultation Paper 322 Product intervention: OTC binary options and CFDs.

The order strengthens protections for retail clients trading CFDs after ASIC said it found that CFDs have resulted in, and are likely to result in, significant detriment to retail clients.

ASIC reviews in 2017, 2019 and 2020 found that most retail clients lose money trading CFDs.

Beyond the AlphaBinary case we note above, what really seems to have tipped ASIC over the edge was its review of how retail traders fared during the first volatile weeks of the COVID-19 pandemic in March and April of this year. During a volatile five-week period in March and April 2020, the retail clients of a sample of 13 CFD issuers made a net loss of more than $774 million. During this period ASIC found that:

- over 1.1 million CFD positions were terminated under margin close-out arrangements (compared with 9.3 million over the full year of 2018), while

- more than 15,000 retail client CFD trading accounts fell into negative balance owing a total of $10.9 million (compared with 41,000 accounts owing $33 million over the full year of 2018). Some debts were forgiven.

ASIC Commissioner Cathie Armour said,

‘Heavy losses sustained by retail clients trading in highly leveraged CFDs and ongoing market volatility during the COVID-19 pandemic highlight the need for stronger CFD protections in the product intervention order.’

‘The leverage ratio limits in the order aim to reduce the size and speed of retail clients’ losses by reducing CFD exposure and sensitivity to market volatility. This follows similar measures introduced in major overseas markets, including the United Kingdom and European Union’ Commissioner Armour said.

The order will remain in force for 18 months, after which it may be extended or made permanent. Civil and criminal penalties apply to contraventions of the product intervention order.

ASIC’s consideration of feedback on its proposal in CP 322 to ban the issue and distribution of binary options to retail clients is ongoing.

Regulatory Guide 272 Product intervention power provides an overview of ASIC’s product intervention power, when and how ASIC may exercise the power, and how a product intervention order is made.

On 22 August 2019, ASIC released CP 322 seeking feedback on proposals to use its product intervention power to address significant detriment to retail clients resulting from over-the-counter (OTC) binary options and CFDs. CP 322 attracted over 400 responses from consumers, consumer groups, CFD issuers, industry bodies and other stakeholders.

A CFD is a leveraged derivative contract that allows a client to speculate in the change in value of an underlying asset, such as foreign exchange rates, stock market indices, single equities, commodities or cyrptoassets.

In ASIC’s product intervention order:

- major currency pair means any two of the Australian dollar, British pound, Canadian dollar, euro, Japanese yen, Swiss franc and US dollar;

- a minor currency pair is any currency pair that is not a major currency pair;

- major stock market indices are the CAC 40, DAX, Dow Jones Industrial Average, EURO STOXX 50 Index, FTSE 100, NASDAQ-100 Index, NASDAQ Composite Index, Nikkei Stock Average, S&P 500 and S&P/ASX 200;

- a minor stock market index is any stock market index that is not a major stock market index.

In addition to the product intervention order, ASIC’s actions to address concerns about CFDs include:

- enforcement action to address misconduct

- public warning notices and other statements

- surveillance projects and thematic reviews

- stronger regulations

- extensive retail client education campaigns and guidance for CFD issuers.

ASIC’s full Public Order regarding the new CFD rules can be seen here (pdf).