Estonia based Retail FX and CFDs brokerage firm Admirals Group AS, which operates the Admirals brand via subsidiary Admiral Markets AS, has released its full year 2021 results indicating a significant decline in revenues and profits.

The second half of 2021, however, was a slight improvement over 1H-2021 which saw Admirals post a large revenue decline and net loss for the period.

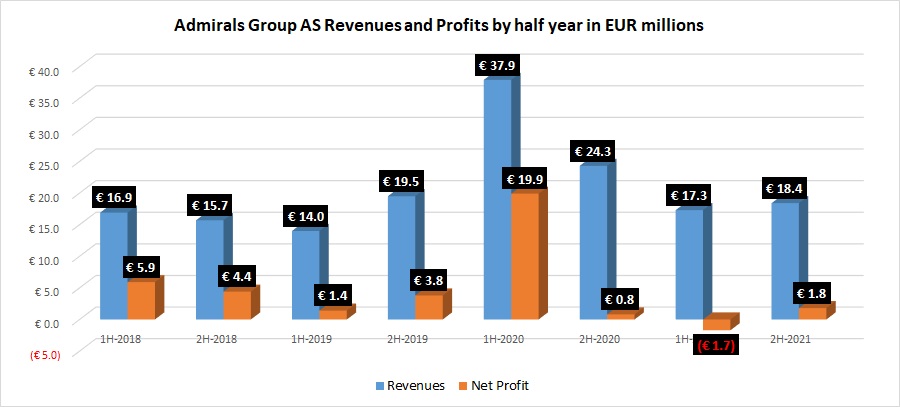

For the full year 2021, Admirals Group brought in €35.7 million in Revenue, down 43% from a company record €62.2 million in the previous year. The second half of 2021 saw Admirals record €18.4 million in Revenue, slightly (6%) improved from €17.3 million in 1H-2021.

On the bottom line Admirals basically broke even for 2021, reporting net income of €0.1 million versus €20.7 million in 2020, but again the second half was improved over 1H-2021 which was Admirals post a loss of €1.7 million.

One metric that looked to be strong at Admirals in 2021 was new client applications, with 2021 being the most successful year in the history of Admirals on that score. In 2020, Admirals had 93,703 client applications, which increased to 123,714 in 2021.

Admiral Markets AS was founded in 2003. In 2009, the Estonian Financial Supervisory Authority granted Admiral Markets AS the activity licence no. 4.1-1/46 for the provision of investment services. The Company is part of an international group which operates under a joint trademark – Admirals.

The main activity of Admirals is the provision of trading and investment services (mainly leveraged and derivative products) to retail, professional and institutional clients. Customers are offered leveraged Contract for Difference (CFD) products in the over-the-counter market, including Forex, indices, commodities, digital currencies, stocks and ETFs, as well as listed instruments.

The Company’s activities have mostly targeted experienced traders, but since this past year Admirals also strengthened its position in the beginner’s segment. Therefore, the Company focuses on the improvement of the general trading skills of experienced traders and the training of new enthusiasts as well.

In addition to the provision of other support services, under White Label agreements, Admiral Markets AS, being the administrator and developer of the platform, provides all sister companies that are part of the same consolidation group the possibility of using the investment platform. In line with the Group’s strategy, the sister investment companies of Admiral Markets AS hedge the risks arising from their customers’ transactions in Admiral Markets AS, which is also their main liquidity partner. Due to this, the results of Admiral Markets AS depend on other companies in the Group.

In addition to the services offered to retail, professional and institutional customers, Admiral Markets AS also acts as a provider of support services for its consolidation group companies, being responsible for all key middle and back-office functions: administration and development of IT platforms, risk management, liquidity provision, marketing, financial services, compliance.

The licensed investment companies that are a part of the same consolidation group as Admiral Markets AS are Admiral Markets UK Ltd, Admiral Markets Pty Ltd, Admiral Markets Cyprus Ltd, Admiral Markets AS/ Jordan LLC and Admirals SA (PTY) Ltd. Admiral Markets AS has a license granted by the Estonian Financial Supervisory Authority. Since Admiral Markets AS and other licensed investment companies that are part of the same consolidation group use the same joint trademark, the reputation of the trademark of Admirals has a major direct impact on the financial indicators as well as the business success of Admiral Markets AS.

Admiral Markets AS has subsidiaries in Canada and Jordan. The branch in Poland and the representative office in the Russian Federation were closed in connection with shaping the strategy of Admiral Markets AS’ parent company Admirals Group AS for the coming years. As the branch and representative office were not engaged in providing investment services nor had clients, the closing didn’t have a significant impact on Admiral Markets AS’ business or financial results.

Other companies that are part of the same consolidation group as Admiral Markets AS at the time of publishing this report are Runa Systems UPE, AMTS Solution OÜ, AM Asia Operations Sdn. Bhd., PT Admirals Invest Indonesia LLC, Admiral Markets Canada Ltd, Gateway2am OÜ, Admiral Markets Europe GmbH, Admiral Markets France (Société par actions simplifiée), Admiral Markets Espana SL. Runa Ukraine LLC, Admirals Digital Limited, Moneyzen OÜ and Moneyzen Collateral Agent OÜ.