HSBC Holdings plc (LON:HSBA) today posted its financial results for the third quarter of 2021, with Forex revenues staging a drop from the year-ago period.

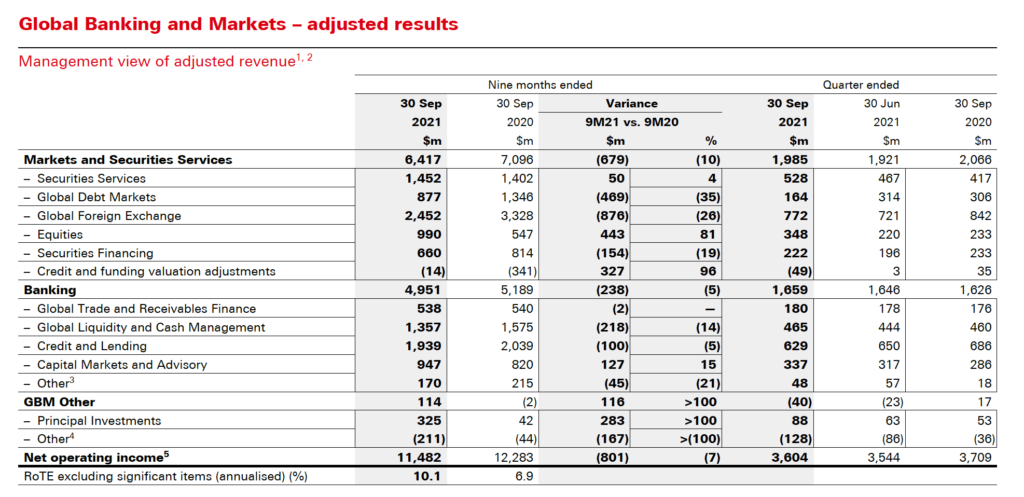

Global Foreign Exchange revenues amounted to $772 million in the third quarter of 2021, down from $842 million a year earlier.

For the first nine months of 2021, global FX revenues totalled $2.45 billion, down 26% from the equivalent period a year earlier.

During the three months to end-September 2021, reported profit after tax grew to $4.2 billion and reported profit before grew to $5.4 billion. The increase was driven by a release of expected credit losses and other credit impairment charges (‘ECL’) and a higher share of profit from HSBC’s associates.

All regions were profitable in the third quarter of 2021, demonstrating continued earnings diversity. Asia contributed $3.3 billion to Group reported profit before tax, while in HSBC UK reported profit before tax increased by $1.0 billion to $1.5 billion.

Reported revenue was up 1% to $12.0 billion including a favourable foreign currency translation movement. Adjusted revenue fell 1% year-on-year to $12.2 billion, primarily reflecting unfavourable market impacts in life insurance manufacturing in Wealth and Personal Banking (‘WPB’) and lower revenue in Markets and Securities Services (‘MSS’). Notwithstanding these factors, HSBC has seen continued good performances in areas of strategic focus, including wealth and trade finance products.

On 2 August 2021, the Directors approved an interim dividend for the 2021 half-year of $0.07 per ordinary share. The interim dividend was paid on 30 September 2021 in cash in US dollars, or in sterling or Hong Kong dollars at exchange rates determined on 20 September 2021.

The Group will not pay quarterly dividends during 2021, but will review whether to revert to paying quarterly dividends at or ahead of its 2021 results announcement in February 2022.

The revenue outlook is becoming more positive, with fee growth across many of HSBC businesses and a stabilisation of net interest income, which HSBC expects to begin to increase in the coming quarters from lending growth and earlier than anticipated policy rate rises.

HSBC said:

“We remain well placed to fund growth and step up capital returns, and now intend to normalise our CET1 position to be within our 14% to 14.5% target operating range by the end of 2022. We intend to achieve this through a combination of growth and capital returns, as well as from an expected $20bn to $35bn uplift in RWAs in 2022 due to regulatory developments. Given our strong capital position and notwithstanding growth opportunities available to us, we intend to initiate a share buyback of up to $2bn, which we expect to commence shortly”.