The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

Global equities ended August near record highs, with the Delta variant failing to infect investor sentiment. But can investors continue to shrug off the undercurrents being caused by the chip shortage?

The New Oil

Semiconductors form the backbone of today’s tech-heavy economy. Simply put, their scarcity threatens growth. While oil facilitated economic expansion for much of the twentieth century, semiconductors play that role in the current century. TS Lombard Economist, Rory Green, called semiconductors “the new oil” and it’s hard to fault his reasoning. While the shortage has hit the automobile industry the hardest, chips play a crucial role as electronic devices and appliances become increasingly “smart”. Semiconductors also play an important role in business expansion, with capex (new capacity and new technologies) often involving significant improvements in computing power.

The semiconductor industry has been in a state of acute supply shortage since the onset of the pandemic. So far this year, we’ve seen production coming to a halt at the factories of some of the biggest automobile manufacturers, including Tesla, Volkswagen, Daimler, and Mercedes-Benz. Production targets have been slashed by companies like Apple, Intel, and Sony. The ongoing chip shortage even threatened to sabotage the global economic recovery.

How Did We Get Here?

The reason for the crisis is multifaceted. However, much of the shortage is traceable back to the US-China trade war. The threat of sanctions caused Chinese firms to stockpile semiconductors and other concerned international buyers who were observing the stockpiling to place large orders. Then came the pandemic. A 50% fall in car sales between February and April 2020 led auto manufacturers to curb their chip orders. This is because modern cars are increasingly more tech-intensive – from driving assistance to temperature and flow controls are tech driven.

As the global economy reopened, demand rebounded in haste and was nearly back at pre-pandemic levels by September 2020, spurred by China’s speedy recovery and concerns around the use of public transport amid social distancing norms. Automakers scrambling to place new orders found that foundries had reallocated capacity to higher-margin chips, such as those used in smartphones. However, the shortage soon spilled over to other industries, with rising demand for work-from-home gadgets and an uptick in demand from crypto miners.

This is when the Delta variant began creating havoc in Asia. The continent houses not only the chip manufacturing juggernauts, but also other components of the supply chain, such as packaging and distribution.

How to Play the Chip Drought

The most obvious way to play the ongoing global chip shortage is to go long on chip manufacturers. Let’s take a look at the two largest chipmakers.

The Taiwanese Semiconductor Manufacturing Company (TSMC) and Samsung own 72% of the global foundry market. These companies have grown along with their fabless designer partners to meet the world’s seemingly unsatiable appetite for computing power. While these stocks are a good play, they have been on investors’ radars for almost a year and their potential may already be priced in. However, there are other interesting names in this segment.

Among them, NXP Semiconductors should definitely be on the watchlist. Although this stock has climbed almost 34% year to date, there is ample steam left. The company has projected robust growth for the rest of this year and into 2022. Analyst sentiment on average is also positive for the company.

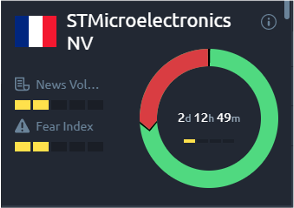

Another stock to keep an eye on is STMicroelectronics, as this could also reap benefits from the electrification of automobiles. Market sentiment for both these stocks is overly positive, as reflected in the Acuity Trading Dashboard. However, sentiment for NXP Semiconductors is more positive, probably because of concerns around the high exposure STMicroelectronics has to a single client. Although this client is the largest company in the world, investors need to look out for Apple gradually bringing chip development in-house.

There are several names in this space, and they are all poised for margin expansion in the near term. This is because demand outpacing supply pushes prices higher. TSMC, for example, has cancelled all customer discounts for 2022. Intel projects chip costs to make up 20% of input costs for manufacturers by 2030, from just under 5% currently.

On the other hand, semiconductor companies will need to keep investing in infrastructure in the near term to cater to the excess demand. This investment may be significant for smaller semiconductor manufactures and investors should monitor capex when choosing their preferred chipmaker play.

Investors can also consider exposure in metals used in semiconductor manufacturing. These include copper, silver.

Another interesting segment is firms providing support services for manufacturing, such as Applied Materials. The company supplies equipment and software used in semiconductor manufacturing. With billions already planned for in strategic capex by foundries, equipment manufacturers can expect an uptick in orders through the next few years.

Another interesting segment is firms providing support services for manufacturing, such as Applied Materials. The company supplies equipment and software used in semiconductor manufacturing. With billions already planned for in strategic capex by foundries, equipment manufacturers can expect an uptick in orders through the next few years.

The pandemic period has also seen increased crypto mining and gaming demand, with both segments hunting for powerful Gaming Processing Units (GPUs). Investors could consider GPU providers like Nvidia.

For those interested in auto investing, consider shifting to companies that have skillfully navigated the semiconductor shortage so far. For instance, Toyota’s post-Fukushima business continuity plan required the company to stockpile semiconductors, making it one of the last major manufacturers to announce production cuts in 2021.

Experts project the chip shortage to persist till 2023. So, the global supply crisis could remain a factor affecting investor portfolios at least in the medium term.