CME Group Inc. (NASDAQ:CME) today reported financial results for the second quarter of 2021.

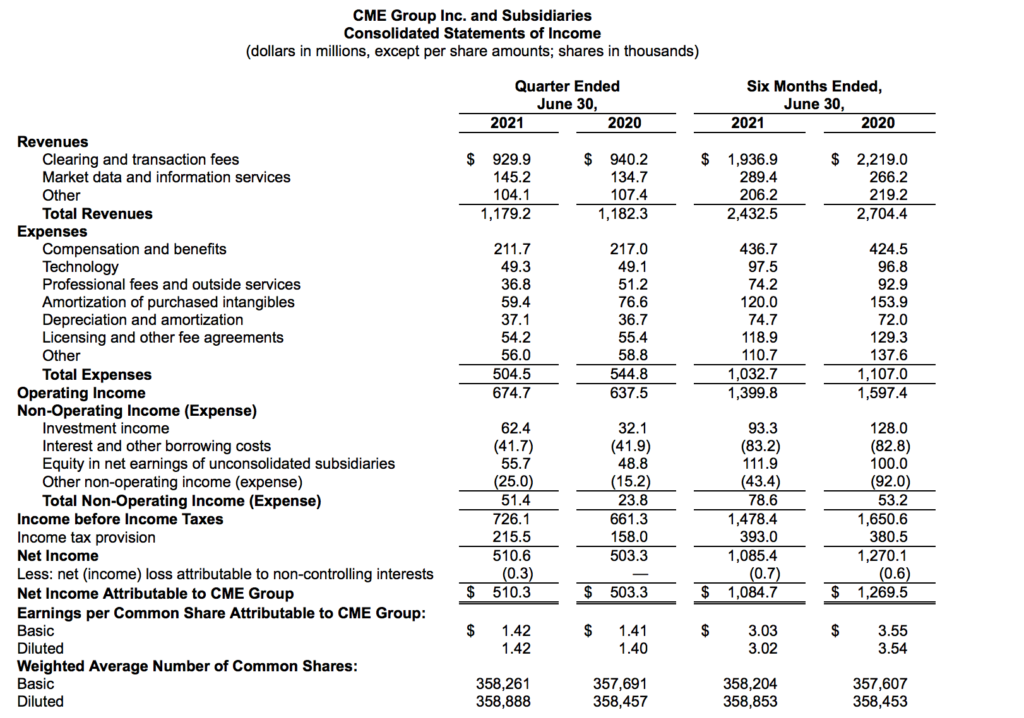

The company reported revenue of $1.2 billion and operating income of $675 million for the second quarter of 2021. Net income was $510 million and diluted earnings per share were $1.42. This compares with net income of $503.3 million registered in the year-ago quarter.

On an adjusted basis, net income was $589 million and diluted earnings per share were $1.64.

“As economies continued to recover during the first half of the year, trading increased across a majority of our asset classes,” said CME Group Chairman and Chief Executive Officer Terry Duffy.

“Average daily volume grew by 5% during Q2, led by double-digit, year-over-year increases in our Interest Rates, Agricultural and Options markets. We also introduced several innovative new products, including a new suite of micro-sized contracts that allow market users to customize their trading and hedging, as well as new ESG-focused futures contracts that help manage climate-related risk. Looking ahead, we will continue to support our clients’ evolving trading needs through additional product innovation and the upcoming launch of our joint venture company to provide post-trade services for OTC markets.”

Second-quarter 2021 ADV was 18.4 million contracts, including non-U.S. ADV of 5.2 million contracts.

Clearing and transaction fees revenue for second-quarter 2021 totaled $930 million. The total average rate per contract was $0.695. Market data revenue totaled $145 million for second-quarter 2021.

As of June 30, 2021, the company had approximately $1.2 billion in cash (including $100 million deposited with Fixed Income Clearing Corporation (FICC) and included in other current assets) and $3.4 billion of debt.

The company paid dividends during the second quarter of $322 million. CME has returned over $15.9 billion to shareholders in the form of dividends since the implementation of the variable dividend policy in early 2012.